Smartest Trends - Winter Outlook 24/25

As the 2024-2025 winter nears, electricity prices may be shaped by La Niña precipitation, increased demand, and potential grid constraints, particularly in the Northeast. Stable natural gas supplies offer some price stability, but high LNG exports and weather-driven spikes could introduce volatility.

Weather

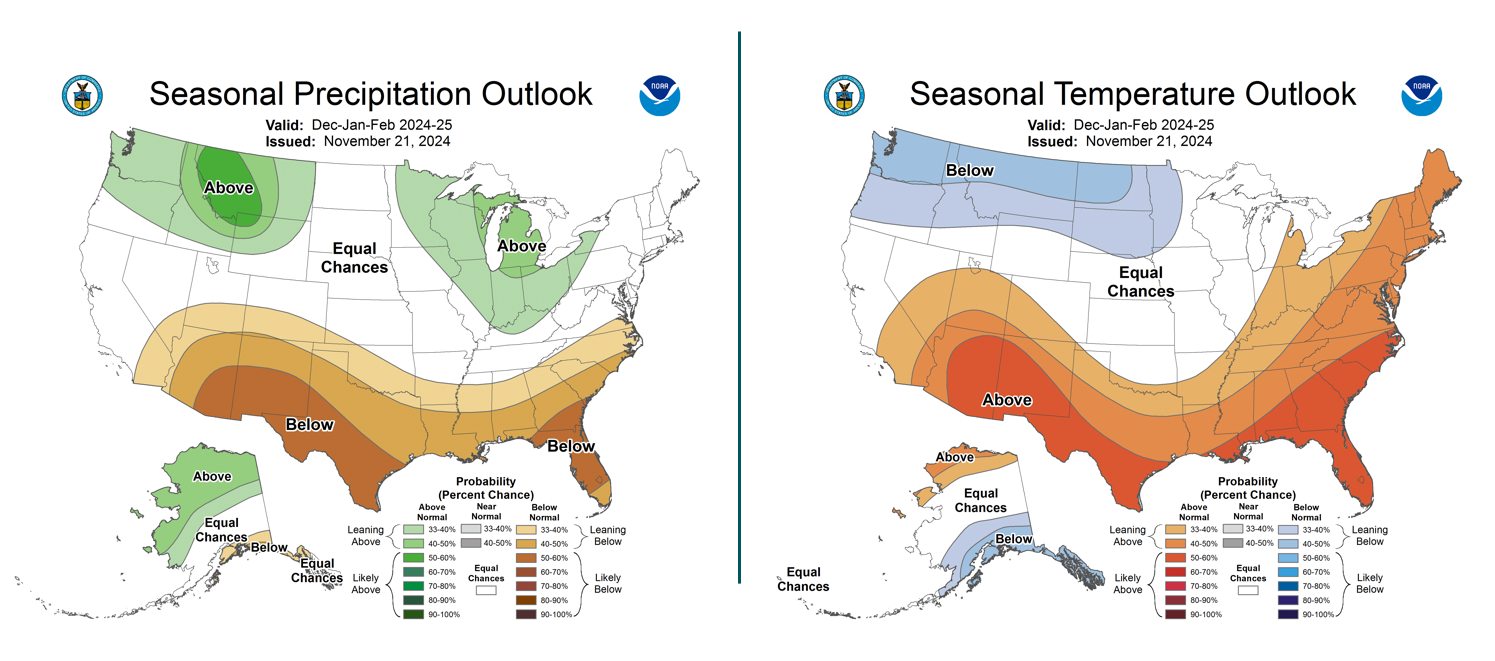

The National Oceanic and Atmospheric Administration (NOAA) has issued its 2024-2025 winter weather outlook, and it presents important updates relevant to the electricity market forecast. The key takeaway is the influence of a weak La Niña pattern, which is expected to shape the winter weather across the U.S., affecting both temperature and precipitation patterns.

The temperature outlook is leaning towards warmer-than-average temperatures throughout the East Coast and Great Lakes. This reduces the likelihood of extreme cold spikes in those regions, which may moderate electricity demand for heating.

However, specifically across the Great Lakes and parts of northern U.S. above average precipitation is likely, which could result in increased snow and ice, potentially leading to higher electricity demand for heating and grid stress during storms.

The EIA is predicting 5% more heating degree days (HDDs) across the Northeast for this winter. HDDs are an aggregate measure of how daily average temperatures deviate from a base temperature of 65°F.

Natural gas

Natural gas storage levels for the 2024–2025 winter are above the five-year average, this provides a cushion against price surges, but increased domestic demand and ongoing high LNG exports (despite the delays) could create some price pressure if cold weather pushes up consumption.

Natural gas is a major fuel source for electricity generation, any shifts in gas prices due to colder weather or supply constraints can lead to higher electricity rates, particularly in gas-reliant regions such as the Northeast.

However, the healthy natural gas storage levels provide some stability, reducing the risk of sharp electricity price hikes this winter, despite increased consumption during the colder season.

Electricity

In the Northeast, electricity prices this winter could be impacted by grid constraints and aging infrastructure, particularly during periods of high demand due to colder temperatures. The region’s reliance on natural gas for electricity generation, combined with limited pipeline capacity, can create bottlenecks, driving up gas and electricity prices. If severe weather causes outages or increases demand spikes, the grid may face additional stress.

Additionally, delays in infrastructure upgrades could limit the ability to meet peak demand efficiently, further raising costs for consumers. Other factors that are expected to increase demand this winter include growing data center usage, manufacturing expansion, and electrification of transportation and buildings.

How does this topic affect our customers?

Protecting your business against higher prices is a no brainer. The challenge is knowing if prices will be going up or down. Historically, winter has been one of the most expensive periods in the year.

Is it a good time to fix?

The current ample natural gas storage levels and stable electricity market conditions, combined with the upcoming colder weather, suggest that now is a favorable time to fix your energy rates to ensure cost stability through the winter months.

Should you explore flexible purchasing options with our managed products?

For our customers on index that want piece of mind from potentially higher prices during volatile periods such as the winter and would like to continue to enjoy market participation, we offer the ability to layer in protection for the period they are most concerned with.

If interested, ask your company representative about our managed product options. A managed product is a custom solution that allows customers to create a dynamic energy buying strategy depending on their business needs, view on the market, etc.

It also allows our customers to make a conscious decision to fix their energy or participate in the market.

Join us on our net zero journey

We’re a global player with the breadth of products and wealth of market experience to help you navigate your energy buying challenges and find the best solution for you.