Posted on: 21/05/2024

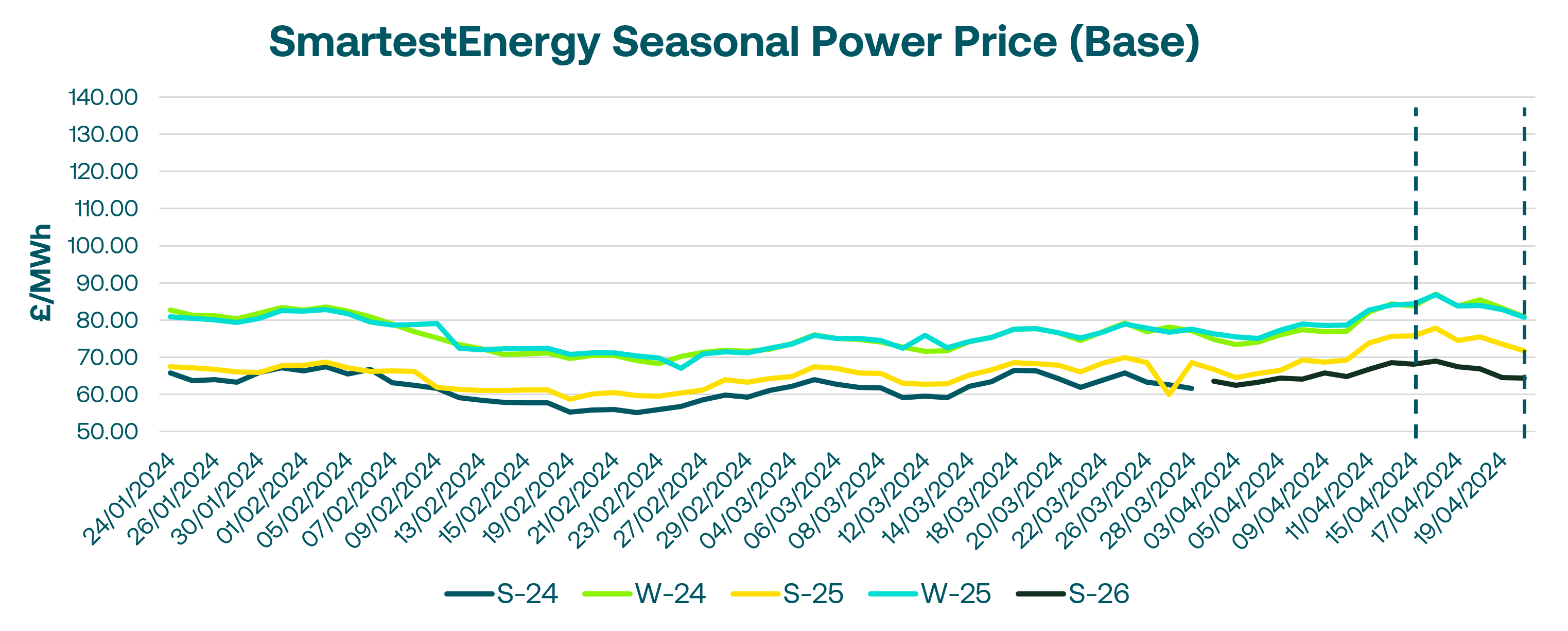

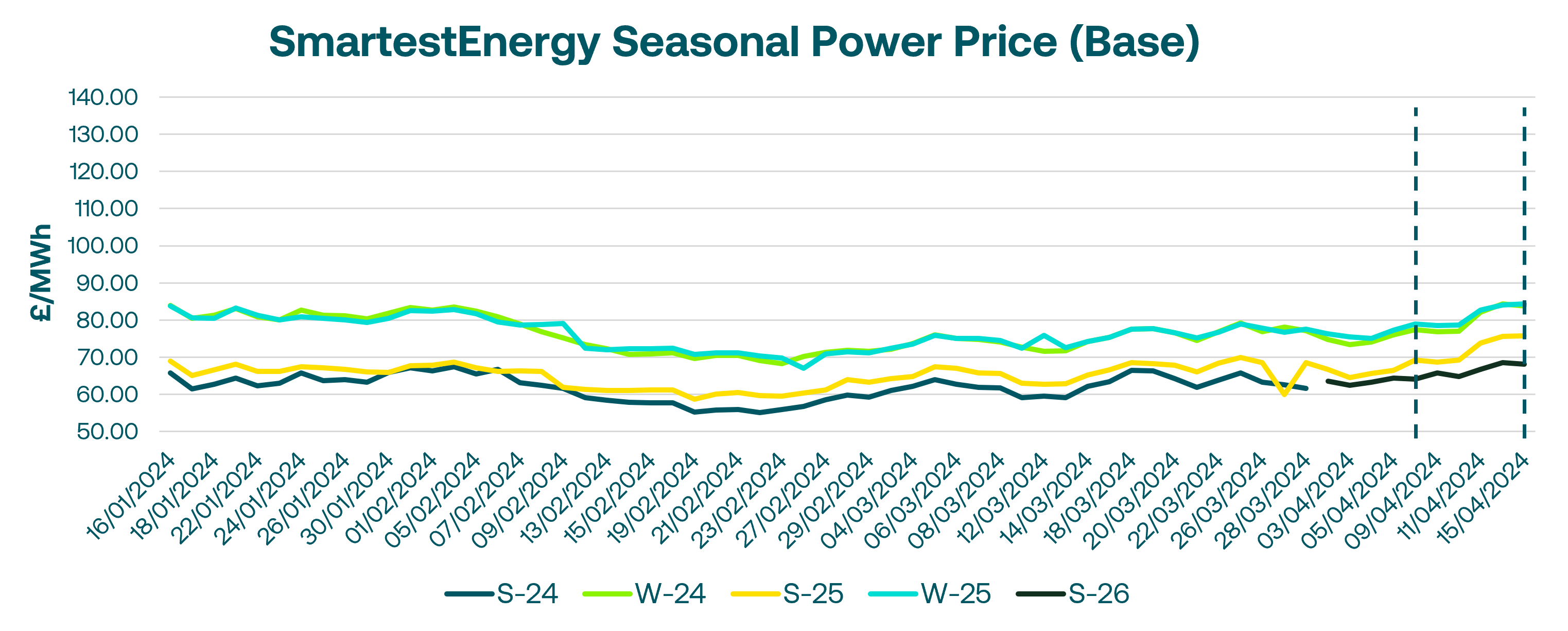

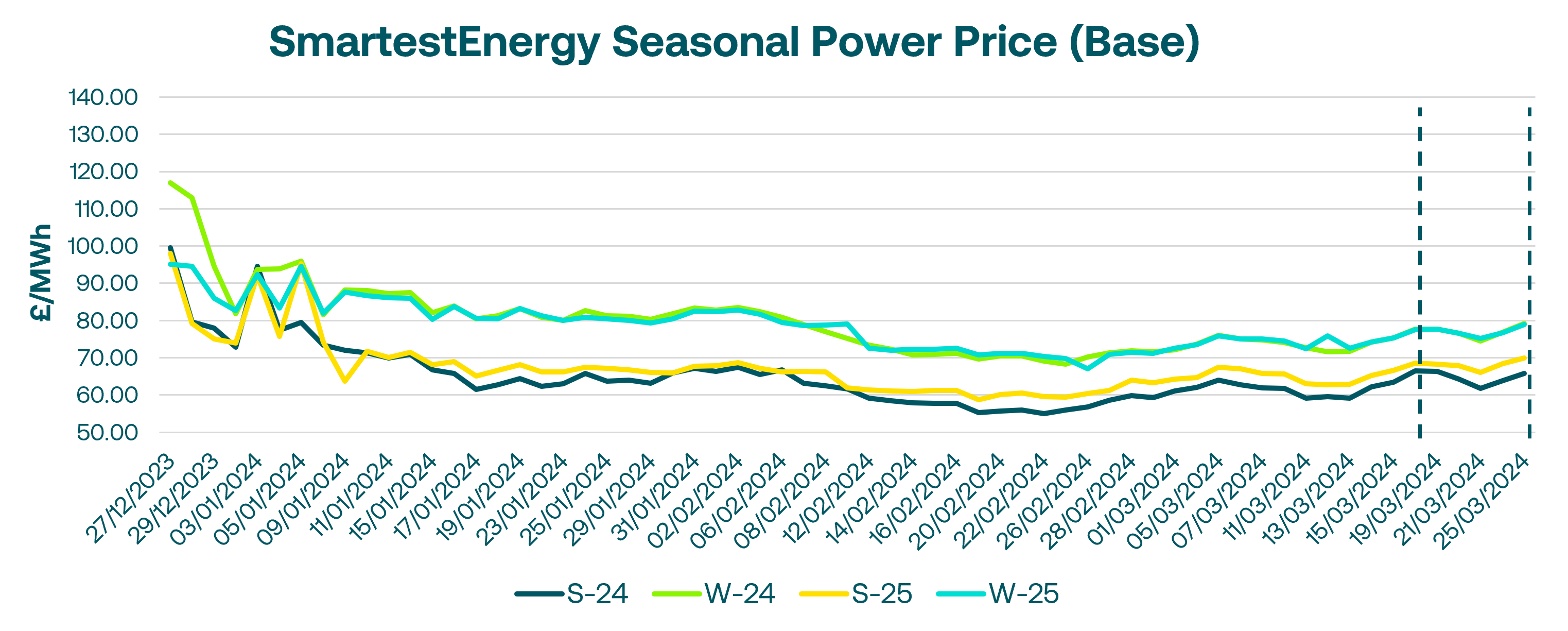

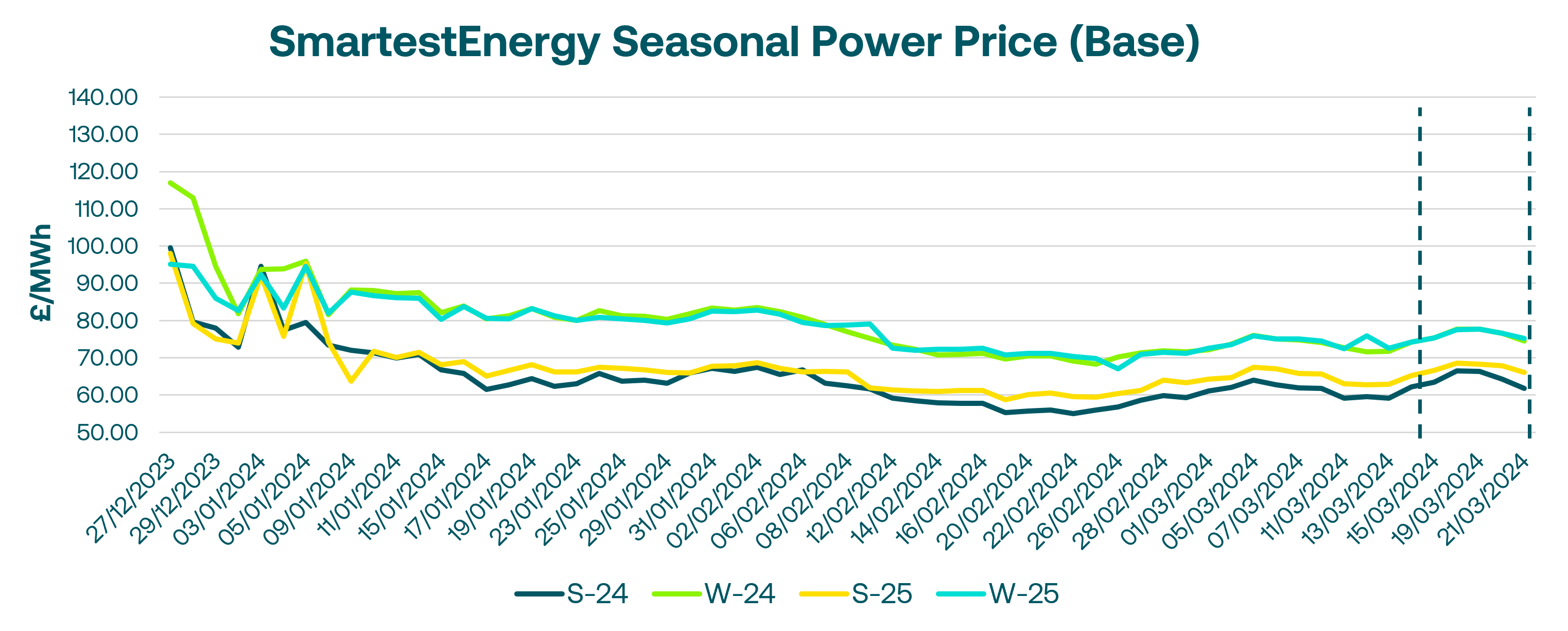

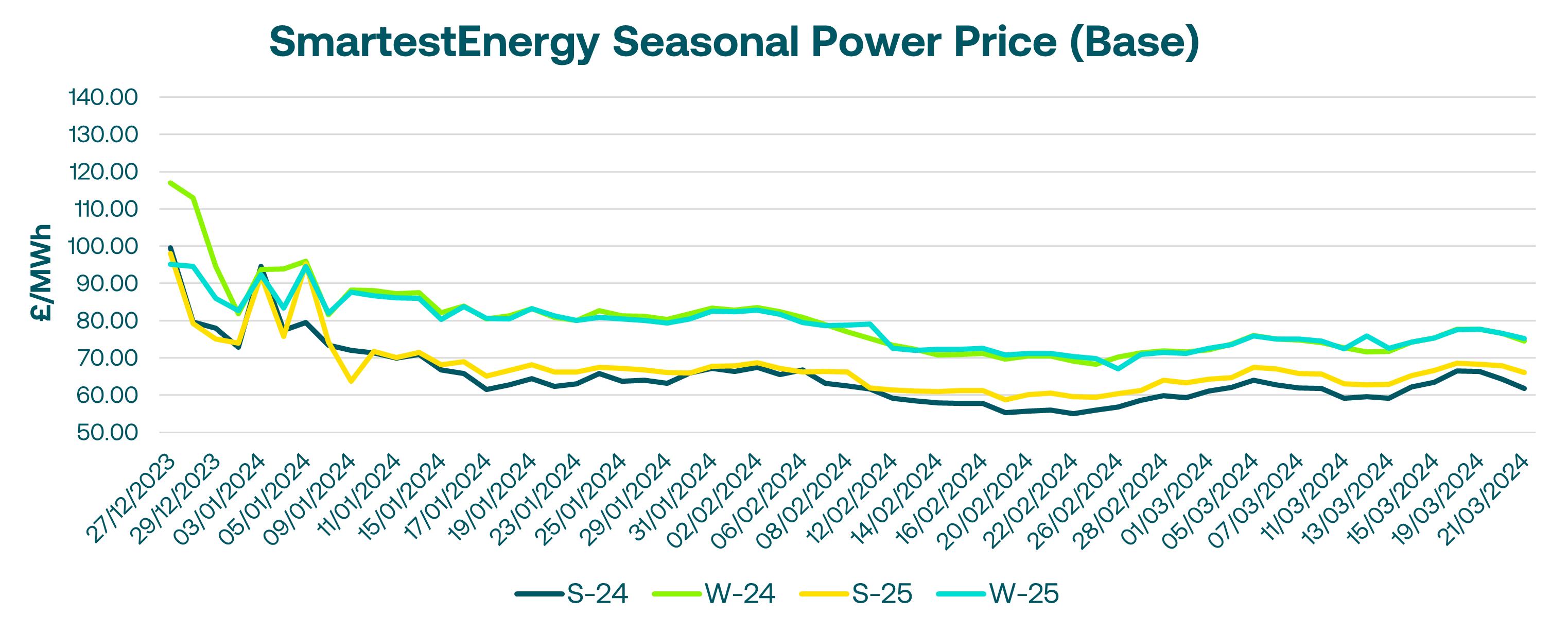

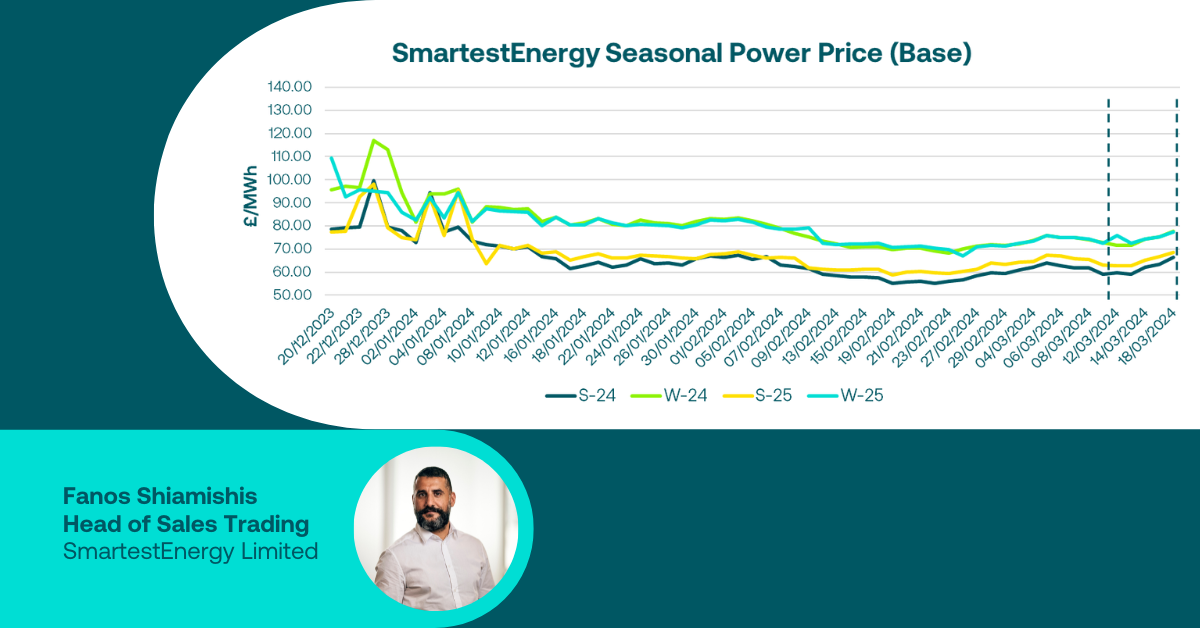

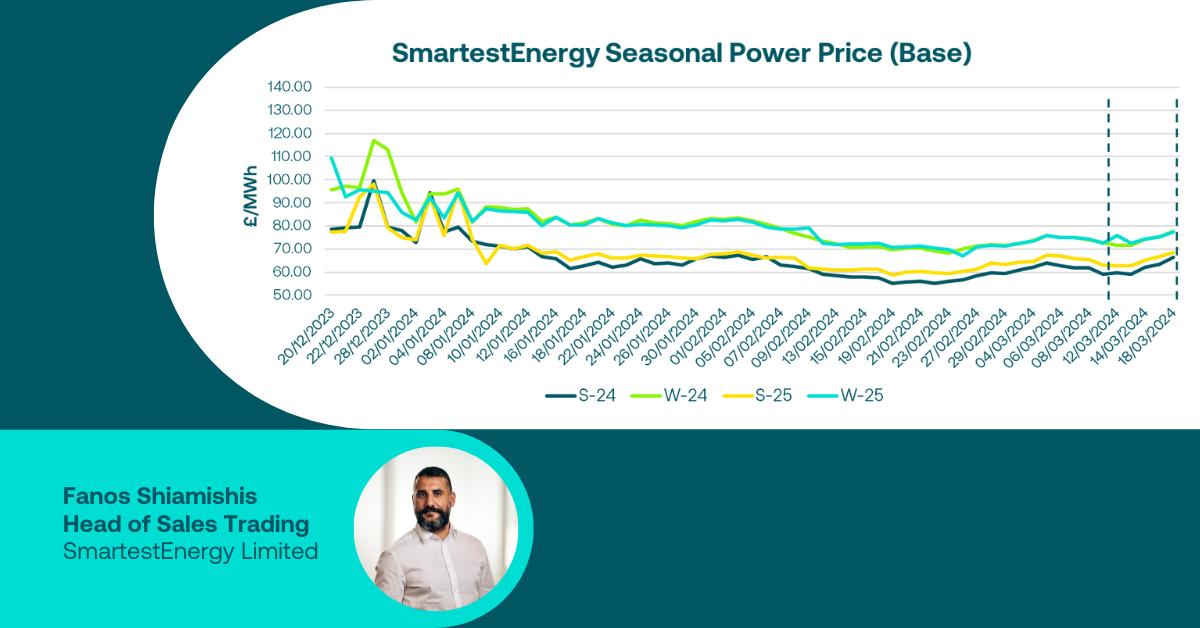

VP Trading, Fanos Shiamishis, reports on energy market activity, covering the period 14th May – 20th May 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £66.88/MWh for the Summer-26 seasonal power price on 20th May. In this blog, Fanos shares the market news and updates from the last week.

UK Gas & Power: Maintenance, Supply Risks Overtake Bearish Signals in European Energy Rally

Tuesday saw the UK gas system undersupplied in the morning. In the short-term, higher-than-average temperatures exerted downward pressure, though stable supply and strong storage injections outweighed concerns over rising Asian LNG prices and geopolitical tensions. LNG prices rose on high temperatures across parts of China and an outage at the Gorgon LNG facility.

On Wednesday, spark spreads widened as gas softened across TTF and NBP hubs, seemingly led by downward moves in carbon prices. The UK gas system opened marginally oversupplied with minimal day-on-day disruptions to supply flows.

European gas recovered ground on Thursday ahead of scheduled Norwegian maintenance outages next week that could take up to 90mcm/day offline by Tuesday. The tense geopolitical situation also lent support, with NATO stepping up security over critical undersea infrastructure amid concerns over potential Russian disruptions like the Nordstream incidents. The Asian JKM LNG benchmark rose on potential market tightening from the ongoing Asian heatwave, compounded by the Bintulu and Gorgon LNG terminal outages. UK power tracked the firming gas and carbon markets higher, with day-ahead baseload clearing £4/MWh up as wind generation was expected to drop Friday.

Gas edged higher on Friday amid the upcoming Norwegian maintenance and low wind output. The UK system was oversupplied but wind was at its lowest weekly level below 1GW, expected to recover but stay under 4GW through the weekend, resulting in slightly elevated gas burn for power.

European gas started the new week stronger on widespread Norwegian maintenance, though some unexpected extensions could not be ruled out. UK power also rallied substantially higher on the back of bullish gas and carbon markets. N2EX day-ahead cleared £5/MWh higher due to stronger NBP gas and forecasts for lower wind generation.

United States

United States Australia

Australia