Posted on: 27/02/2024

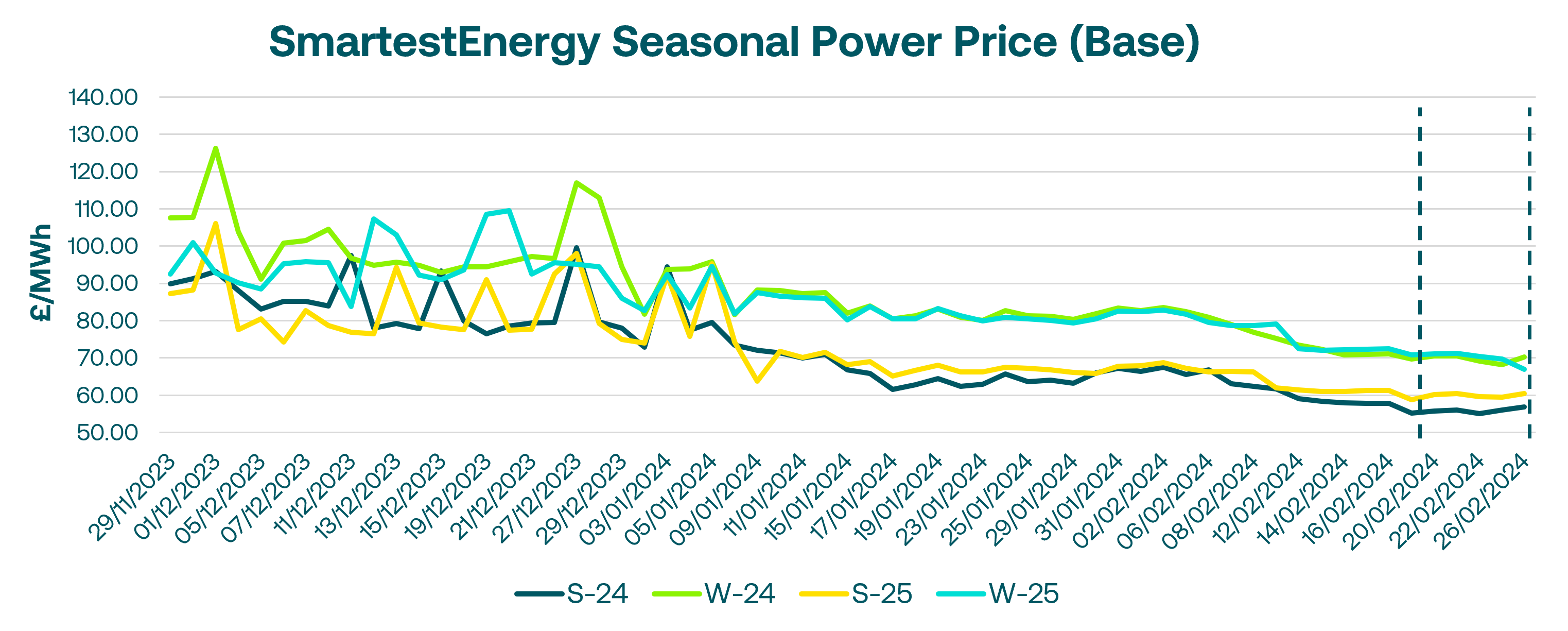

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 20th – 26th February 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £56.82/MWh for the Summer-24 seasonal power price on 26th February. In this blog, Fanos shares the market news and updates from the last week.

European gas hit an over 8.5-month low last Tuesday as fundamentals pointed to a comfortable supply/demand outlook for the remainder of winter. UK power traded up, aided by recovering carbon markets, while UK overnight power dropped to £47.25/MWh on increasing wind generation forecasts.

Midweek saw Norwegian imports to the UK fall day-on-day but demand was also weak with stable LNG deliveries and strong renewable output. Forecasts suggested UK gas storage levels would stay healthy into March. UK power trading focused on 222 MW of March-24 and 170 MW of Summer-24 contracts.

On Thursday, European gas fall to a fresh new low as projections called for above normal temperatures and strong wind power generation over the next two weeks. UK Power softened in line with bearish gas and carbon markets as March-24 baseload traded 445MW.

Friday’s subdued trading activity focused on UK March baseload power. Supply was unchanged but colder temperatures drove a 9mcm demand increase, leaving the UK system 7mcm undersupplied in the morning.

Monday opened with the UK gas system short, but bearish sentiment remained intact amid healthy supply. UK power curve interest was limited - the most traded season was Winter-25 at 51 MW and front months and quarters were most popular.

United States

United States Australia

Australia