Posted on: 13/02/2024

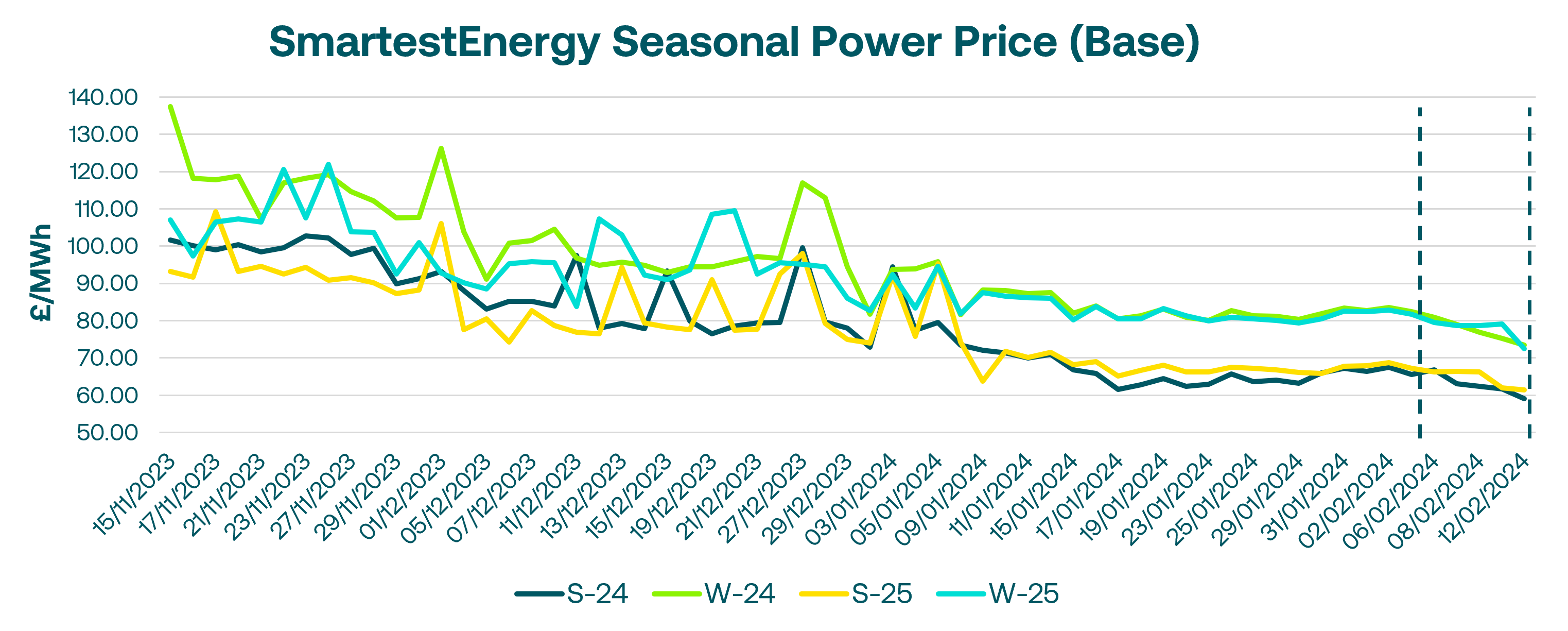

Sales Trader, Yulia Zhizhaeva, reports on energy market activity, covering the period 6th – 12th February 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £66.81/MWh for the Summer-24 seasonal power price on 6th February. In this blog, Yulia shares the market news and updates from the last week.

Following a period of low prices, European gas had a small rebound last Tuesday when an unplanned outage at the Norwegian Nyhamna gas processing plant outage was updated, up 10mcm/day to 52mcm/day, but this was short-lived. UK Power traded lower due to a sharp drop in UKAs, and the most traded product was front month baseload with a total of 106MW.

Into the week, gas and power experienced a down day amid healthy supply. Norwegian flows were up, which offset any colder weather concerns. Meanwhile, wind output dropped to around 2GW after 5 days of staying around 14GW, causing N2EX day ahead to clear higher following the lower renewable output forecast.

On Thursday, European gas prices edged lower again on strong supply fundamentals, with 68% storage levels offsetting the cold spell prospects in the short term. Power prices also reduced as UKA trading marginally higher was not enough to counter the down move driven by natural gas.

At the end of the week, the UK gas system opened marginally long at 1mcm, with the ramping up of Norwegian exports weighing on near-term prices. The increased exports following the Troll field outage assured analysts of supplies across both the UK and Europe, reflected in significant losses on TTF.

To start this week, we saw gas and power decline further amid bearish fundamentals. Norwegian supply was stable, renewable output was strong, and demand was low as the weather forecast remained mild. We saw very thin liquidity on the UK power curve, with a total of 105MW of seasonal volume and only 15MW of Summer-24 changing hands.

United States

United States Australia

Australia