Posted on: 12/03/2024

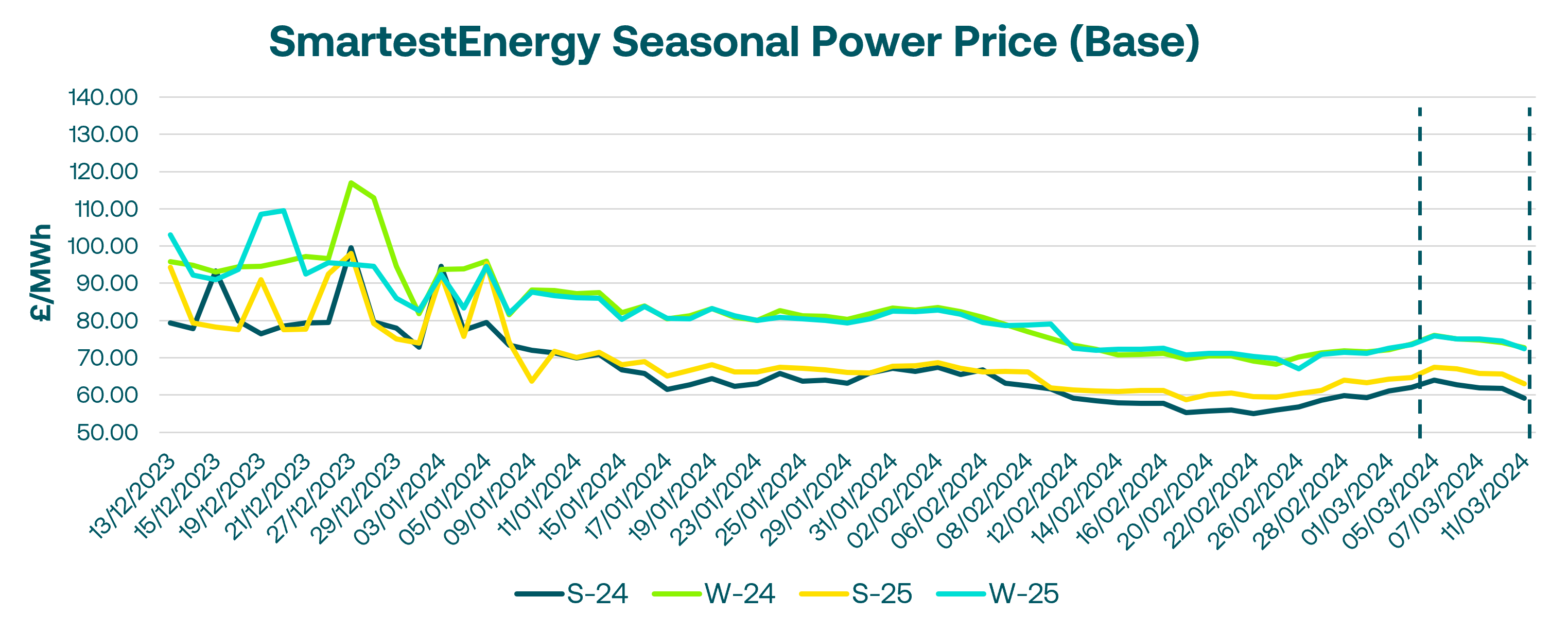

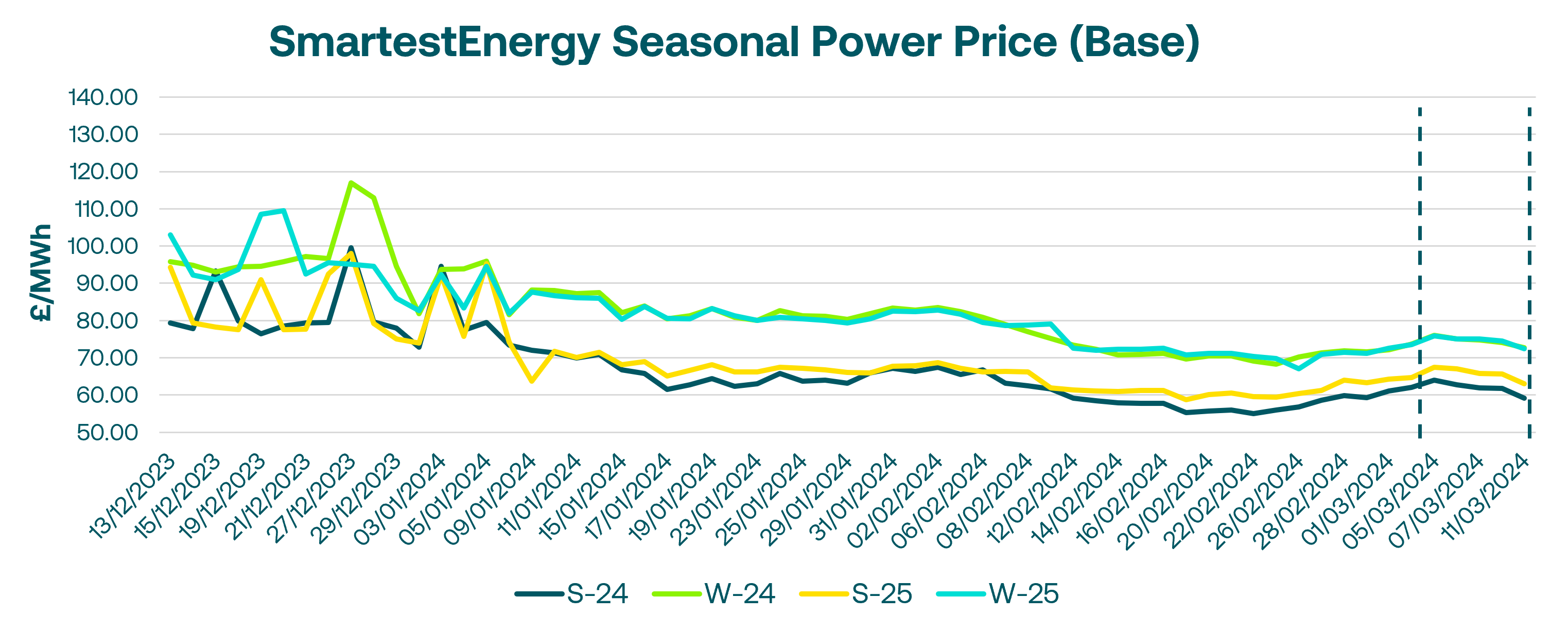

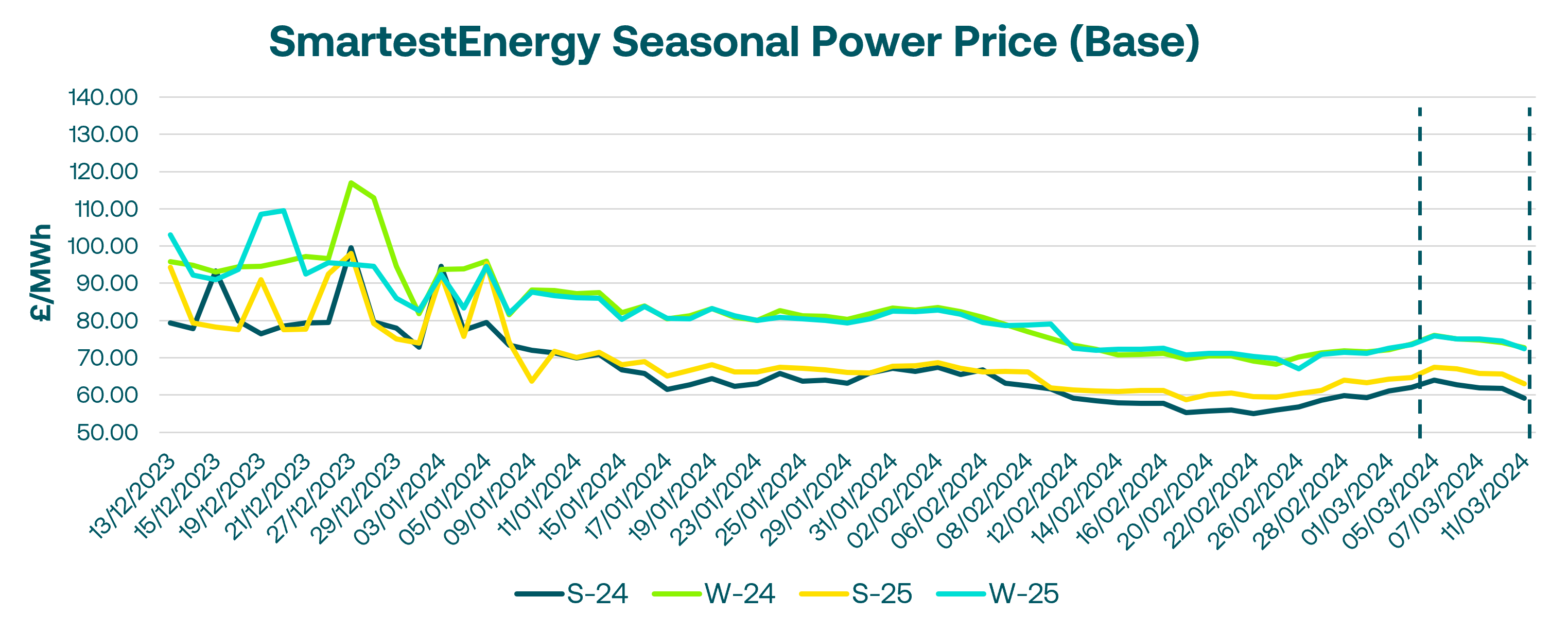

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 5th March – 11th March 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £63.98/MWh for the Summer-24 seasonal power price on 5th March. In this blog, Fanos shares the market news and updates from the last week.

The TTF rally continued on Tuesday with news sources citing the announcement by US Producer EQT of their intended cut in production as the cause of the rally. Citing the oversupplied market and falling prices, EQT will cut production for March by around 30-40Bcf and would not rule out an extension to the cuts beyond March. Traders continued to pay into TTF and NBP with power subsequently tracking.

However, gains were erased Wednesday amid persisting bearish fundamentals. Lower temperatures across Northern Europe and a partial outage at Freeport provided some price support. On the UK power curve, nearly 500 MW of Winter 2024 baseload traded, significantly outpacing activity in other contracts.

European gas traded sideways Thursday as concerns over LNG supply competition from Asia offset bearish signals including muted demand, high storage levels and ample supply. Day-ahead UK power cleared £7/MWh lower on a softer NBP market and expectations for strong 16GW wind generation peaks. Overall UK power was quite illiquid, trading weakly following the NBP.

The UK gas system opened 3mcm undersupplied Friday morning, as reduced LDZ demand failed to offset increased gas burn for power generation. Gas prices beyond the front-month firmed amid risks to Norwegian supply from ongoing maintenance at multiple plants.

Although the UK gas system opened 7mcm short on Monday, fundamentals appeared bearish with LDZ demand as well as gas for power demand both reduced from last week's levels. Norwegian exports increased and all other supply points remained unchanged. The front-month TTF contract retraced last week's gains despite an unscheduled outage at Nyhamma over the weekend taking out 25mcm of supply. With the outage forecasted to be resolved Tuesday, traders grew confident in the supply/demand outlook, leading to extensive profit-taking throughout the day.

United States

United States Australia

Australia