Emerging trends in the future UK PPA market

Power up your PPA knowledge and delve into the evolving landscape of power purchase agreements as Business Development Manager, James Clark, sheds light on the dynamic shifts, risks, and opportunities shaping the renewable energy sector.

Delve into the evolving landscape of power purchase agreements (PPAs) as Business Development Manager, James Clark, sheds light on the dynamic shifts, risks, and opportunities shaping the renewable energy sector, following an engaging ‘PPA Market Outlook’ panel discussion at the All-Energy Conference.

The evolution of the UK PPA market

At 35GW in size, the PPA market in Great Britain has been fundamental to the development of renewable generation capacity, and PPAs will continue to underpin the growth of the renewable sector as electricity demand and the need for greater energy security increases. However, new challenges have arisen following the energy crisis.

Over the past few years, the energy market has experienced extreme volatility like never before. Following extreme lows throughout the COVID-19 pandemic, the outbreak of war between Russia and Ukraine saw power prices hit record highs, with PPA price levels peaking at over £500/MWh in 2022.

During this heightened period, we saw exaggerated risks and opportunities within PPAs, with many generators able to lock in at these high prices, take advantage of the volatility and maximise their assets potential. But ultimately, it was unsustainable and caused a large number of suppliers to exit the market due to constrained credit lines and inflated risks. Meanwhile, for those suppliers that remained, many had to put far higher premiums on to prices to account for the additional risk.

Over time the market subsided, and since then, we have seen UK power prices reduce in value quite dramatically from 2023 and into 2024, trending back towards pre-energy crisis levels. However, with large industry changes on the horizon, such as the UK Government’s current Review of Electricity Market Arrangements (REMA), uncertainty and volatility remain a concern, prompting a realisation from both suppliers and generators that there needs to be some level of risk mitigation moving forward, influencing current PPA trends.

Current PPA trends

Greater flexibility

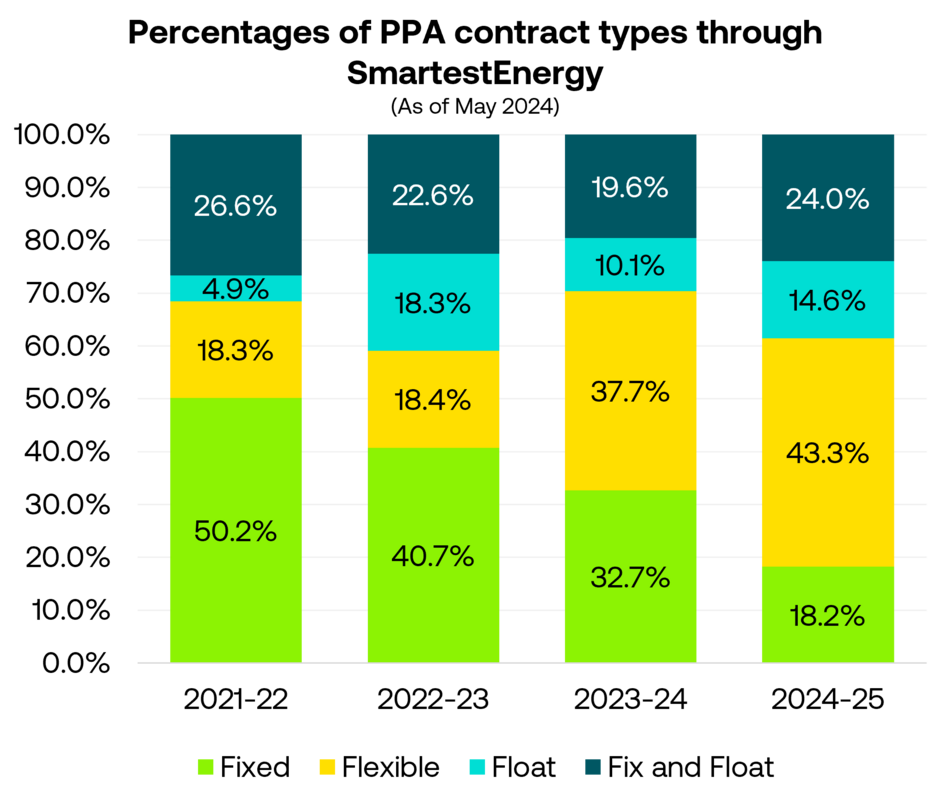

We have already seen this shift start to happen where generators are moving away from traditional fixed prices, fixing in a single time of year, to more flexible PPA products. For example, in 2021-22, we saw 18.3% of our customers opt for flexible products compared to 43.3% so far in 2024-25, whilst fixed PPAs have dropped from 50.2% to 18.2%

Shorter-term utility PPAs

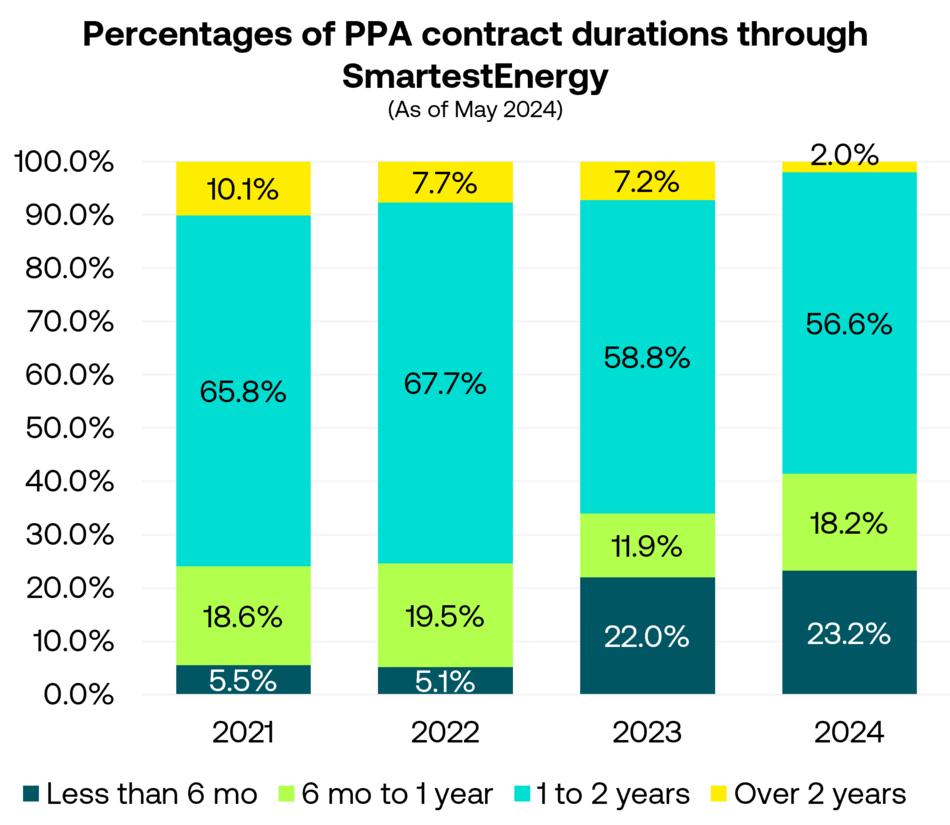

We have also seen a move towards shorter term PPA contract durations. While prices are low, more generators are opting to lock in for shorter periods of time to enable them to fix further if the market price recovers, as shown by the jump from 5.5% to 23.3% in less than 6-month PPA contracts.

Longer-term CfD & CPPA contracts

However, despite the shorter-term utility contracts, the desire for longer-term contracts remains, particularly for new build assets. Contracts, such as CfD PPAs, CPPAs or mixed routes to market, often lasting 10-15 years, offer stability and predictability in revenue streams. For example, SmartestEnergy provides certainty to CfD customers, offering discounts of up to 15 years to the Intermittent Market Reference Price (IMRP). This protection from market and price risk provides a level of reassurance with ongoing revenue certainty.

Increasing demand for CPPAs

Finally, we have seen a rise in CPPAs, with this raised as a hot topic of conversation within the ‘PPA Market Outlook’ panel discussion. According to BloombergNEF’s 1H 2024 Corporate Energy Market Outlook, corporations publicly announced a record 46GW of solar and wind contracts in 2023, up 12% year on year, and as corporate sustainability targets grow, we can only see this increase further.

Looking ahead to the future PPA Market, we can see many of these trends continuing to play a vital role in helping independent generators balance the risks and opportunities in the changing market, and we are proud to act as a reliable partner to help navigate these.

Explore how to manage your risks with a Power Purchase Agreement

Download our latest guide to managing risks with a PPA to find out how you can use a Power Purchase Agreement to maximise your assets’ potential whilst assessing new risks and opportunities in the changing market.