ROC price: What's next for recycling distribution?

Vishnu Aggarwal, Deputy VP Origination and Renewables Trading provides an update on the UK ROC market, following the compliance deadline for the submission of ROCs for 1st April 2020 – 31st March 2021, known as Compliance Period (CP)19.

Vishnu Aggarwal, Deputy VP Origination and Renewables Trading provides an update on the UK ROC market, following the compliance deadline for the submission of ROCs for 1st April 2020 – 31st March 2021, known as Compliance Period (CP)19.

The total CP19 RO obligation, as published by Ofgem, was 119,090,729 ROCs, down from the 130,183,968 ROCs submitted in CP18, which is predominantly due to the demand destruction throughout the pandemic.

Under the supplier obligation,105,263,447 ROCs submitted towards the total obligation – that’s 88.4% of the total obligation. This has resulted in a required total buyout payment of £692,055,464, resulting in an approximate recycle value of £6.50/ROC.

The initial recycle distribution has now been made by Ofgem to all suppliers, depending on the number of ROCs that were submitted in the compliance period. The total value of a ROC can be considered to be the Buyout price, which is fixed, plus the ROC Recycle rate, which is calculated at the end of the compliance period. The confirmed recycle is £3.87/ROC, so we expect the combination of the Late Payment distribution and Mutualisation to be £2.63/ROC, to make up the total £6.50/ROC value.

CP19 has the 3rd highest volume of banked ROCs ever

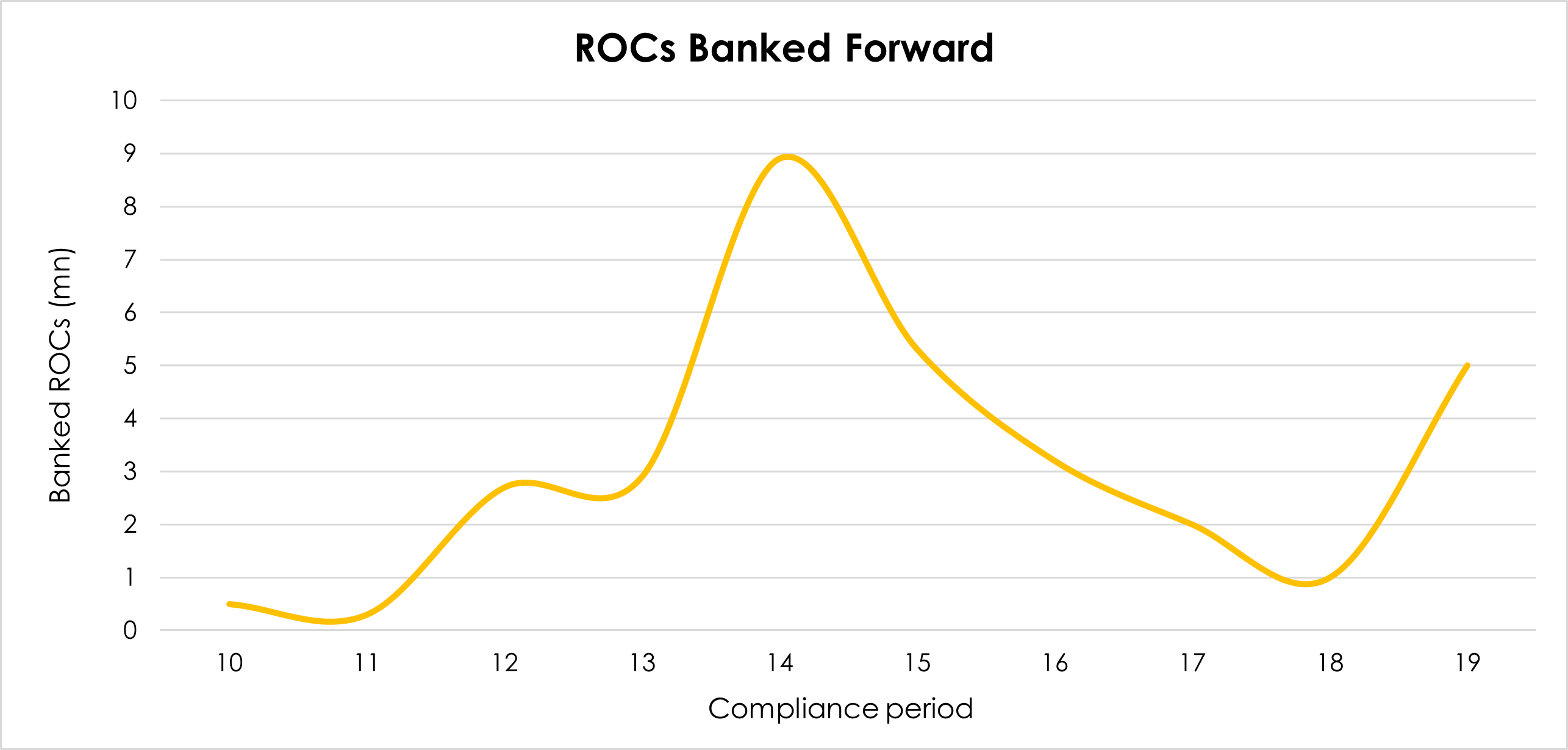

CP19 has had the 3rd highest volume of banked ROCs, with in excess of 5 million CP19 ROCs being carried into CP20. The below graph shows the historic volumes of banked ROCs with the previous highs being 8.9 million in CP14 and 5.3 million in CP15.

CP19 has had the 3rd highest volume of banked ROCs, with in excess of 5 million CP19 ROCs being carried into CP20. The below graph shows the historic volumes of banked ROCs with the previous highs being 8.9 million in CP14 and 5.3 million in CP15.

Towards the end of the compliance period, the incentive to bank ROCs from CP19 into CP20 was high due to a low recycle value being forecast for CP19 and a high recycle value being forecast for CP20. High volumes of banked ROCs has of course resulted in an increased recycle value for CP19 and a decreased recycle value for CP20 due to the additional supply.

With the deadline for ROC submissions comes the deadline for the suppliers who have not met their obligation to pay the buyout price for their remaining dues. The CP19 aggregated Buyout payment due is £692,055,464 and the late payment deadline for suppliers to meet their buyout.

During CP19 and more recently in CP20, a significant number of suppliers have ceased trading. They have supplied volumes in CP19 and CP20 and are now unable to meet the relevant RO supplier obligation.

What’s next?

As we have heard in recent energy news, a number of suppliers have ceased trading and some did not meet the statutory deadline of 31st October for the CP19 obligation.

37 energy suppliers failed to meet the early September deadline, leaving a record £276 million shortfall in the fund. This equates to around £2.63/ROC submitted through late payment and mutualisation.

With the mutualisation trigger set at £16,940,000, CP19 will be the fourth year in succession in which mutualisation will occur. In CP20, given the recent legislative change, the mutualisation trigger will be much greater at £62,780,000, but this year the expected mutualisation value has already exceeded £109,000,000. This is likely to still be less than our expected final CP19 mutualised amounts which could still rise yet as we approach the late payment deadline. However, with much certainty we can say this will be the year of the highest mutualisation ever in the scheme’s history.

Explore our renewable energy certificates and carbon credits

As expert providers of certificates and carbon credits, we can help corporates take climate action and wholesale counterparties access the right instruments on a global scale.