Posted on: 02/04/2024

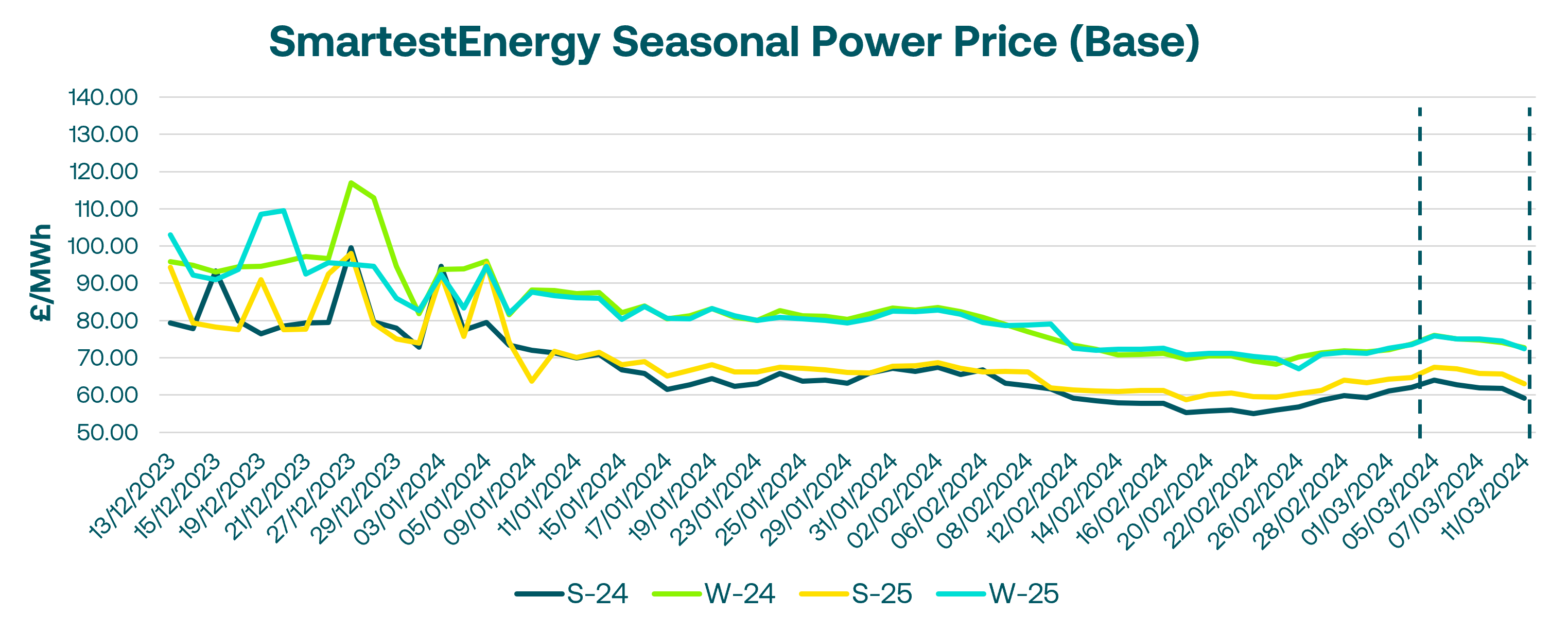

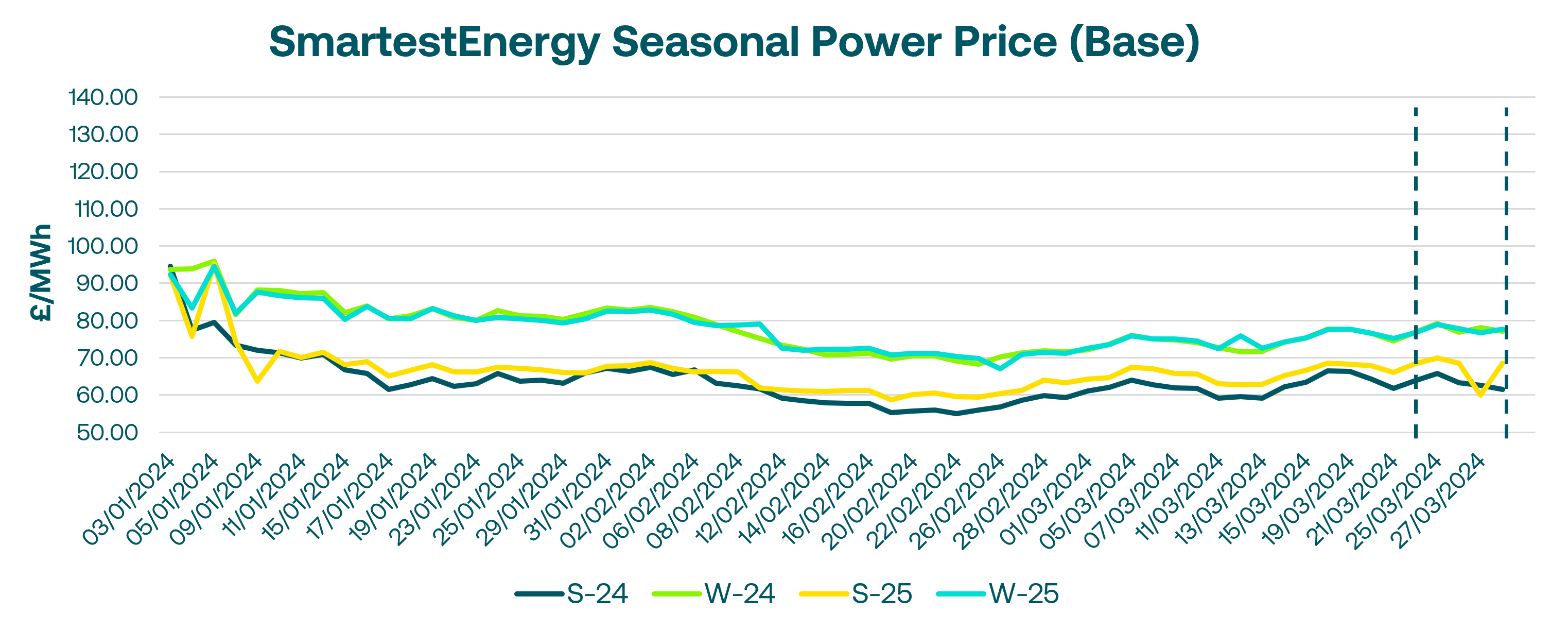

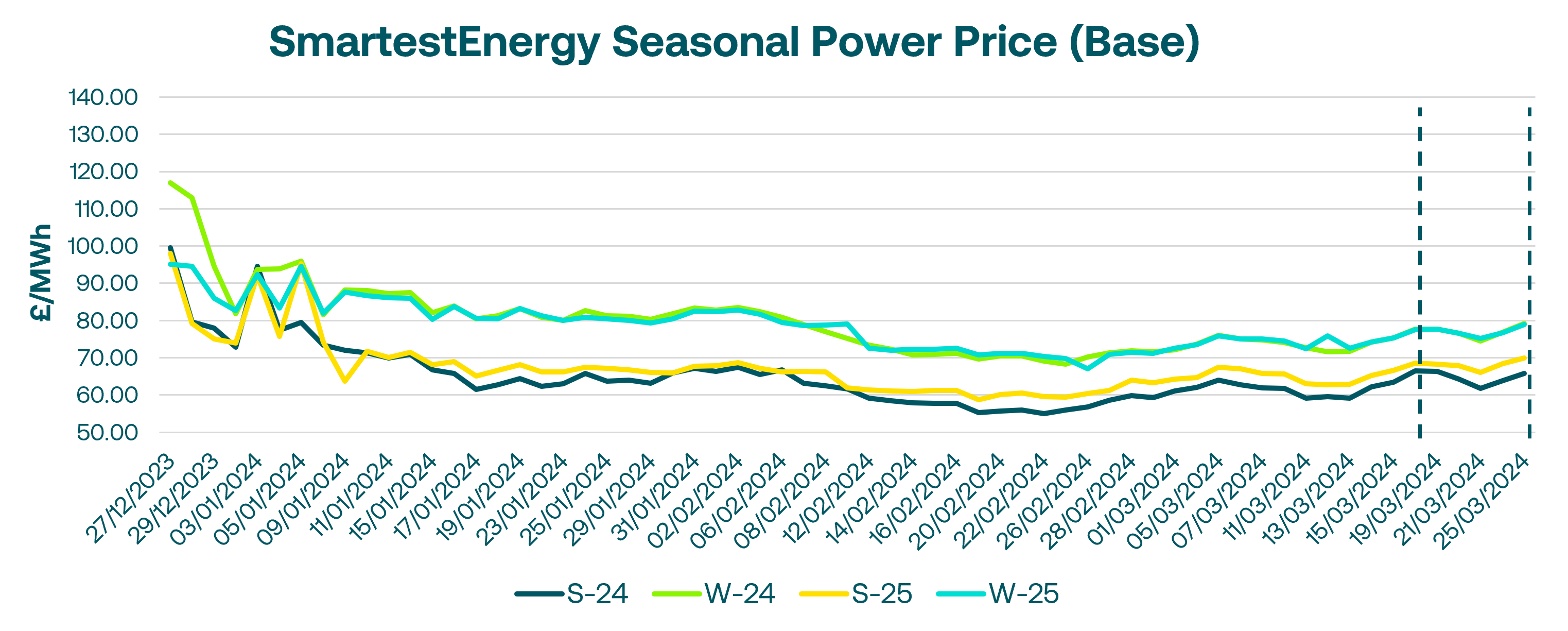

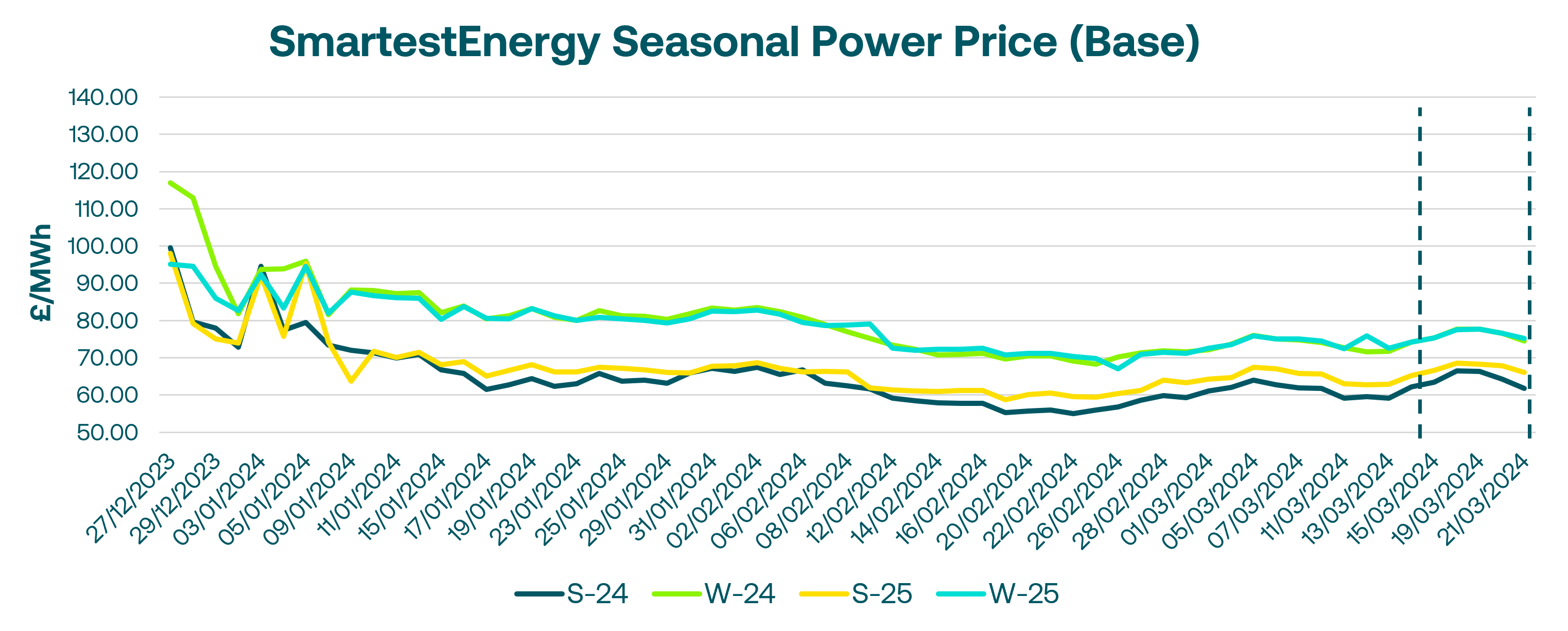

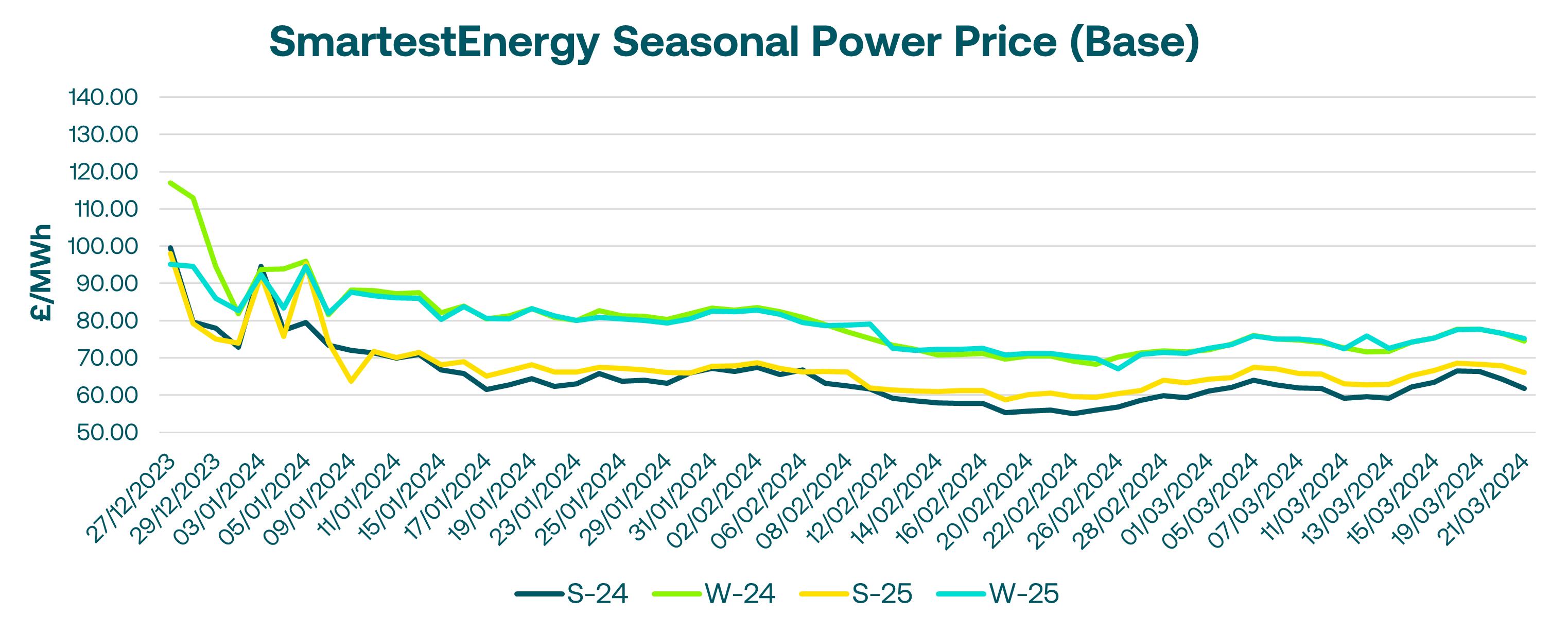

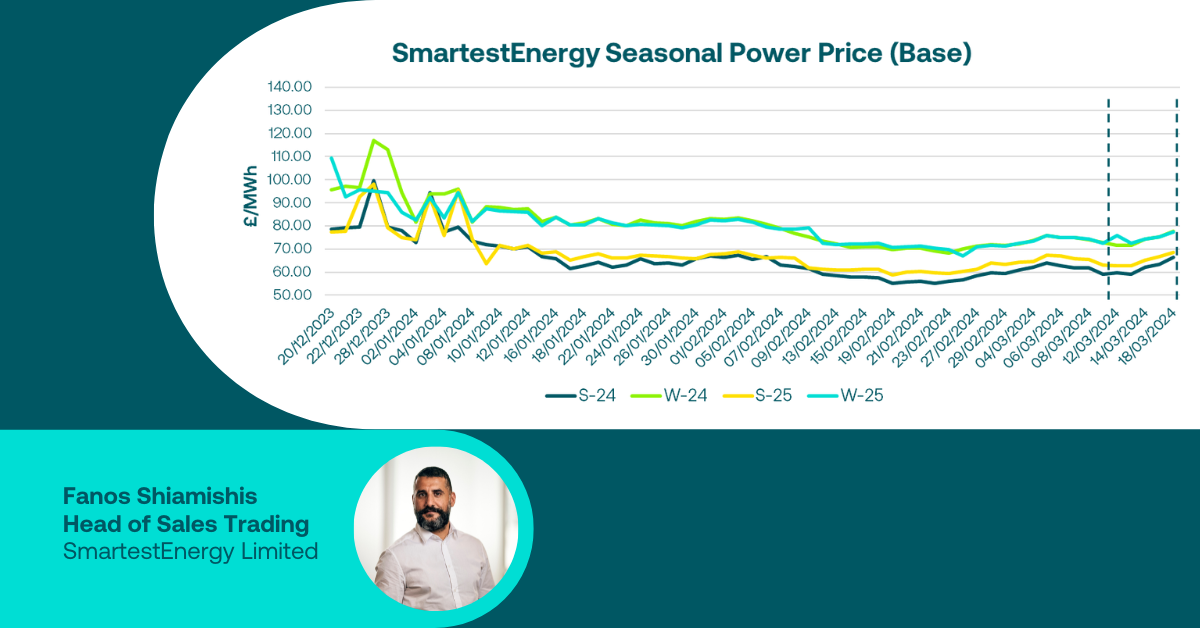

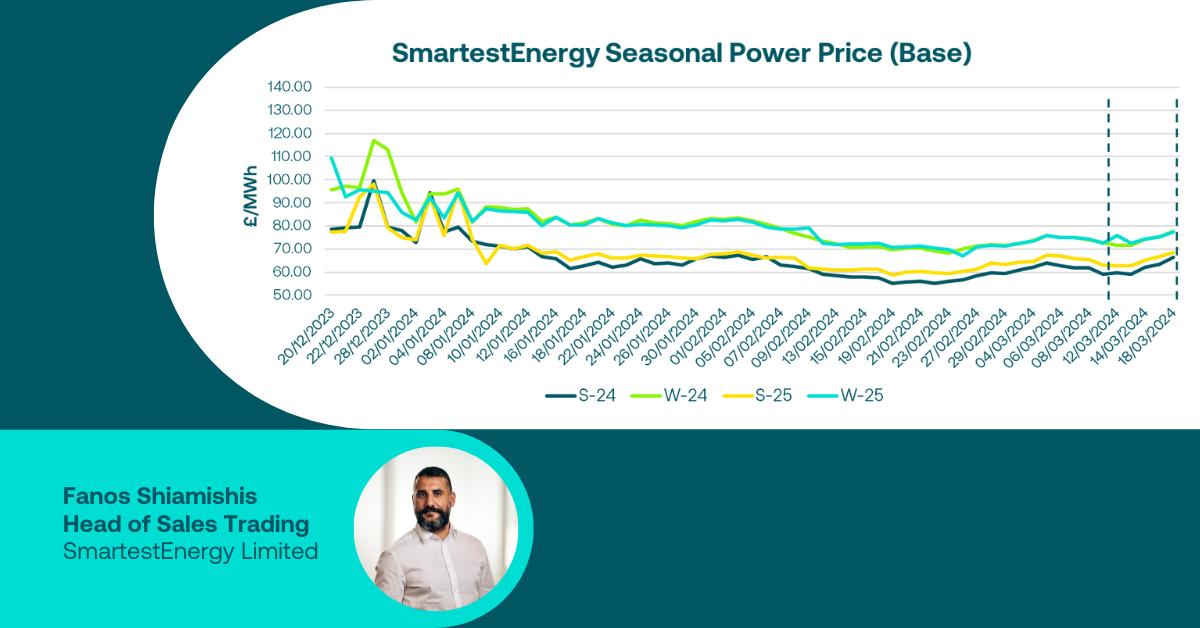

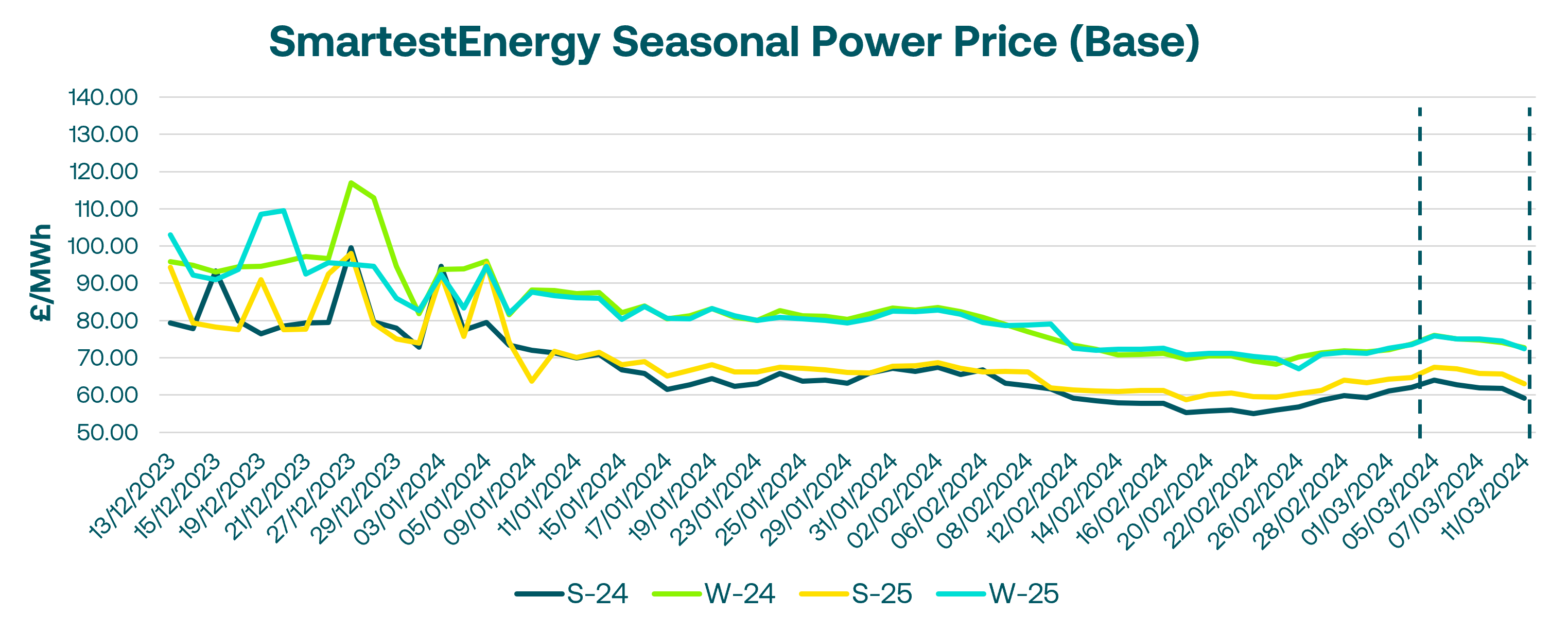

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 26th March – 28th March 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £63.25/MWh for the Summer-24 seasonal power price on 26th March. In this blog, Fanos shares the market news and updates from the last week.

European gas prices retreated on Tuesday, buoyed by healthy supplies. Europe remains on track to exit winter with record-high storage levels for this time of year. However, ongoing geopolitical concerns and competition from Asia for liquefied natural gas (LNG) cargoes keep a lid on any significant price drops. In the UK, power prices also saw a respite, helped by a weak emissions market. The April 2024 UK baseload contract witnessed impressive trading volumes of 708MW as its expiry approached. Day-ahead baseload prices dropped nearly £10/MWh due to falling prompt gas prices and forecasts of strong wind generation reaching 12GW overnight.

Markets on Wednesday navigated a balance between ample storage inventories and lingering geopolitical uncertainties. Norwegian gas flows to the UK increased slightly. UK power trading extended out to Winter 2028 contracts, although volumes remained light beyond Winter 2026. Overall liquidity was limited, but a decent volume still traded for April 2024, Q3 2024, and Winter 2024 contracts.

The week closed with marginal gains on Thursday, despite bearish sentiment fueled by high storage levels and robust LNG supplies. Europe continues to be the preferred destination for US LNG cargoes due to ongoing tensions in the Red Sea and shallow water levels in the Panama Canal disrupting alternative routes. Limited interest was seen in Q2 2024 and Summer 2024 UK power contracts, while April 2024 remained the most active, with over 230MW changing hands as the contract nears delivery over the weekend.

United States

United States Australia

Australia