Posted on: 09/04/2024

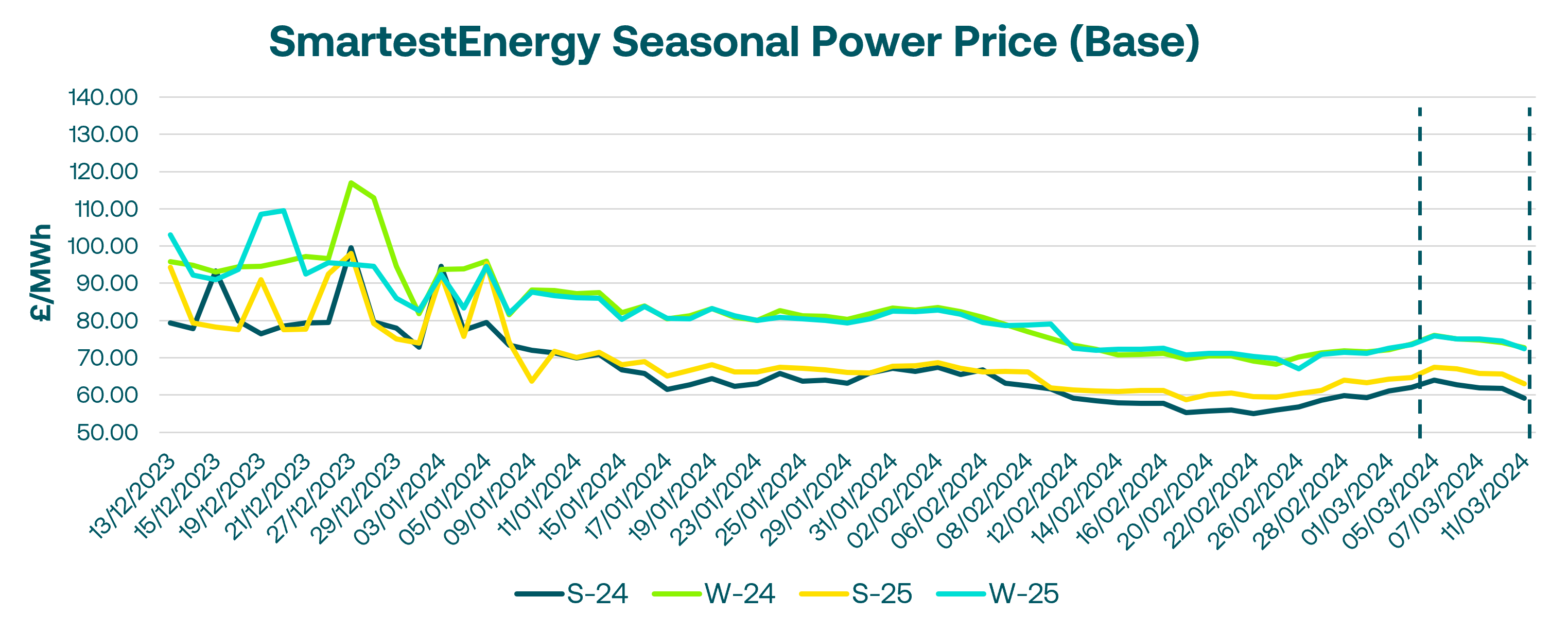

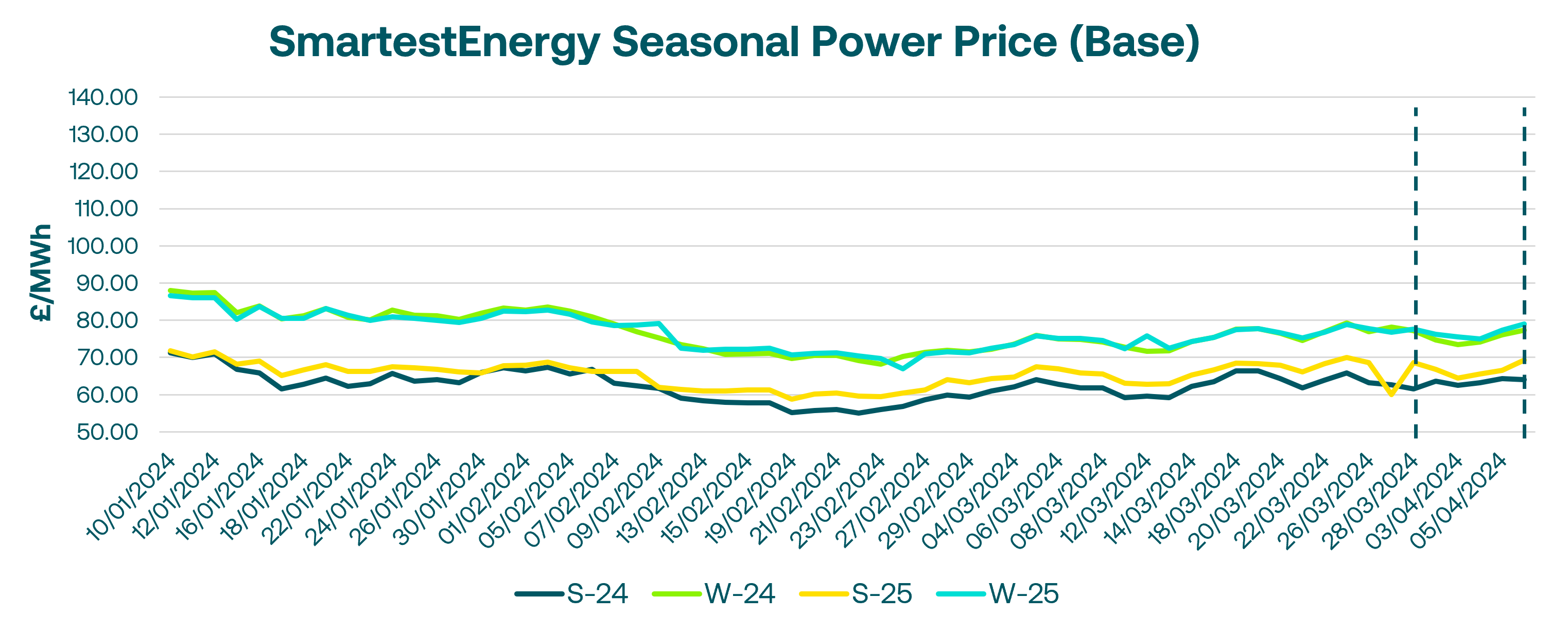

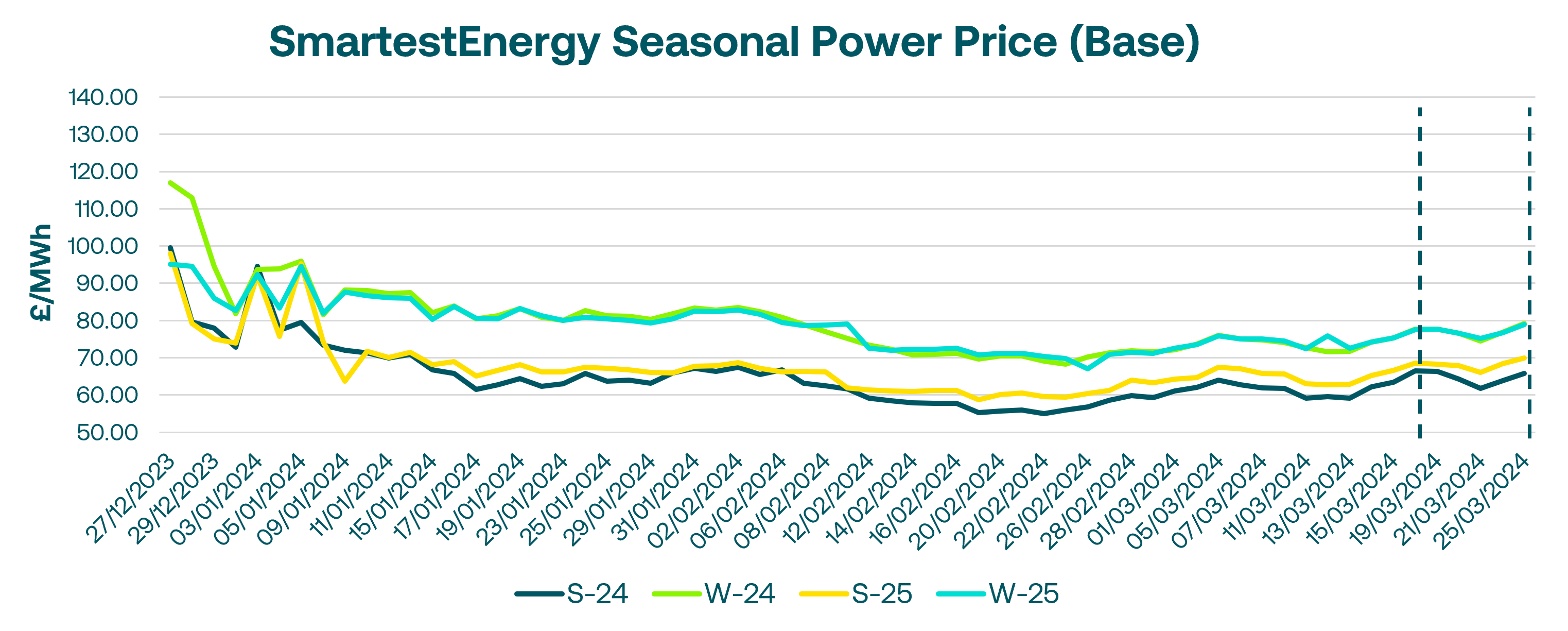

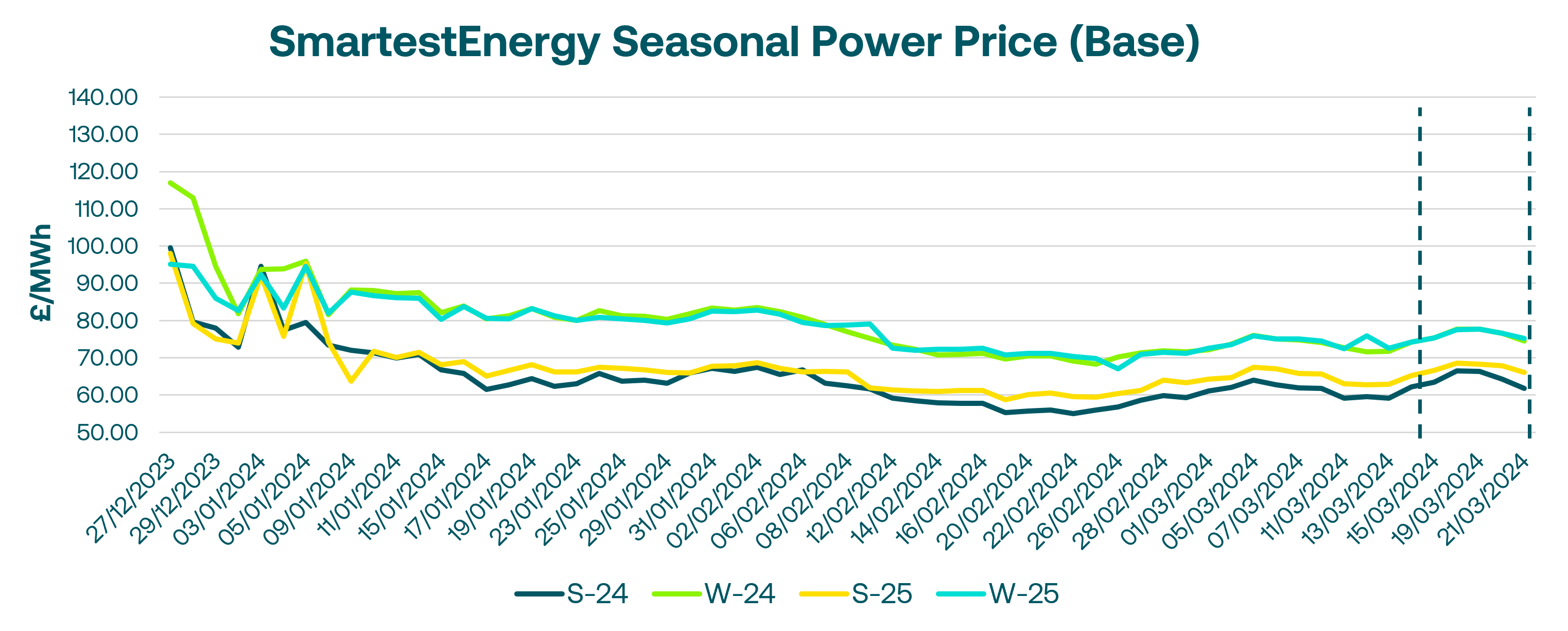

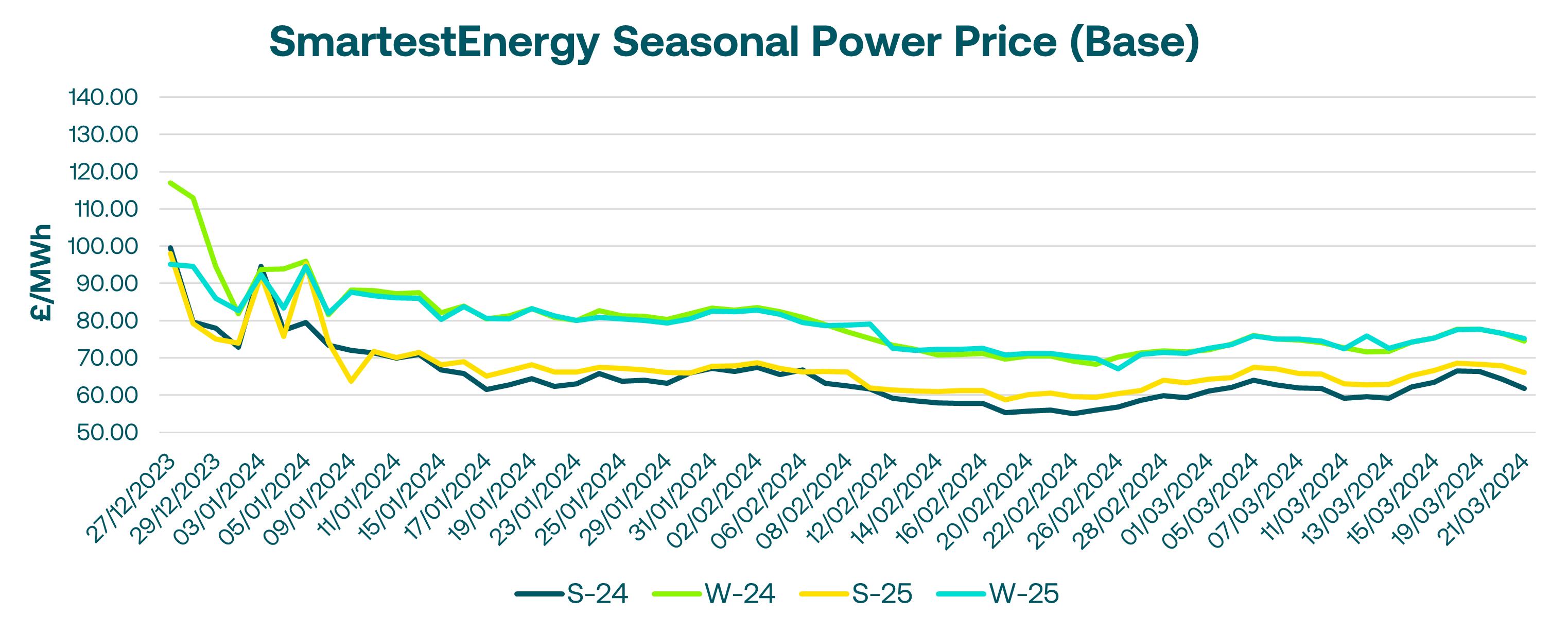

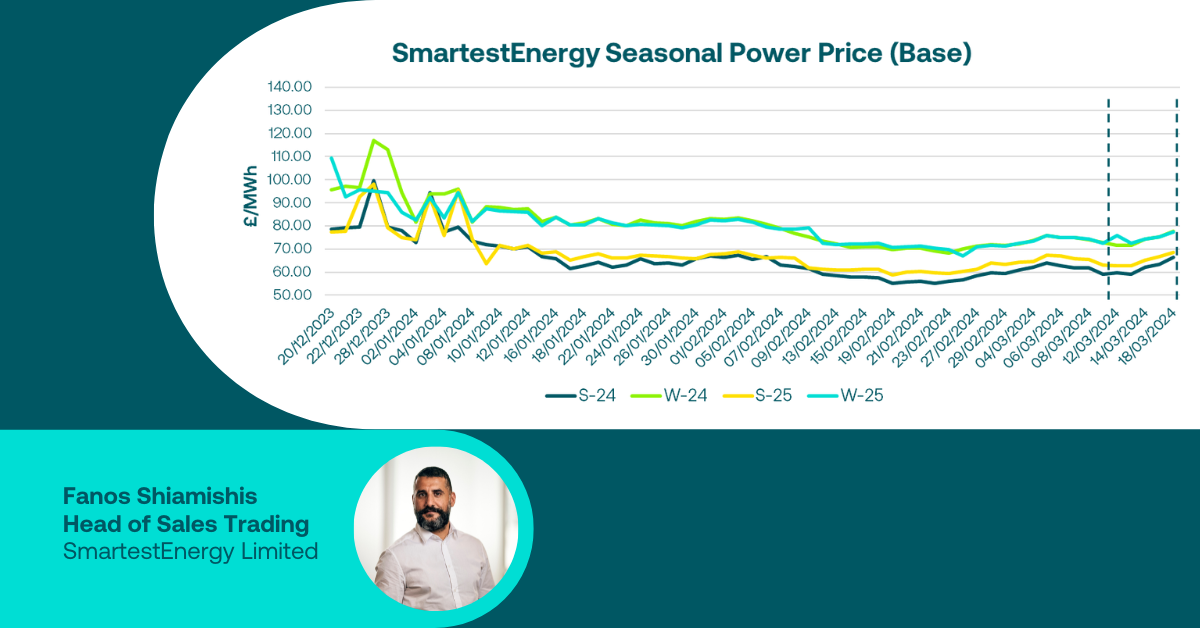

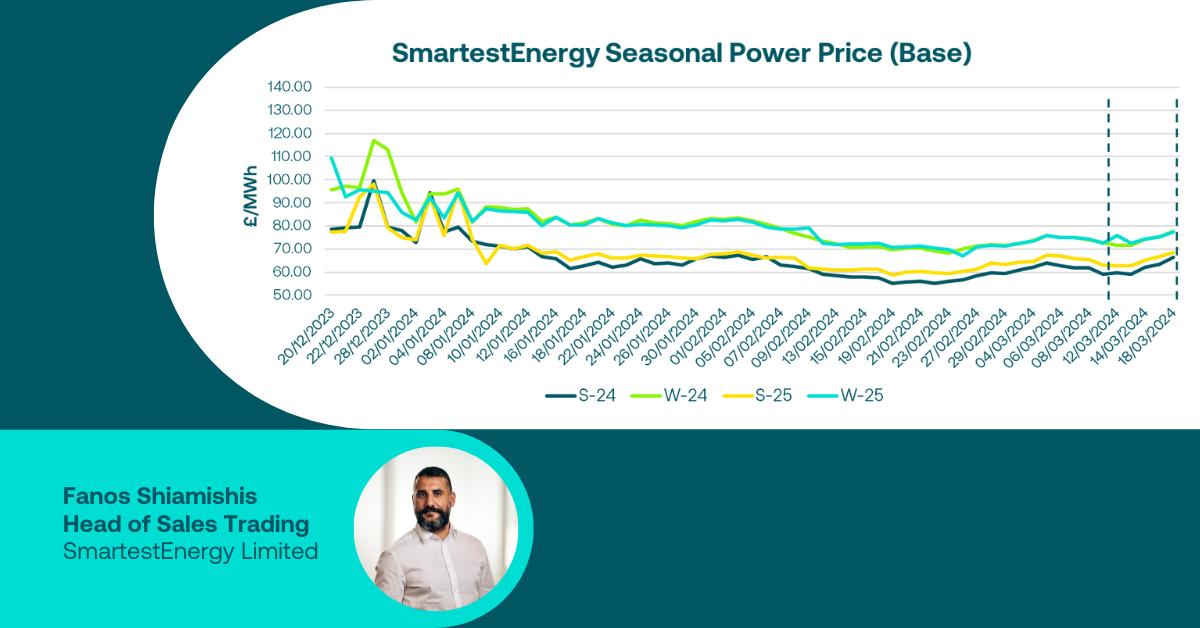

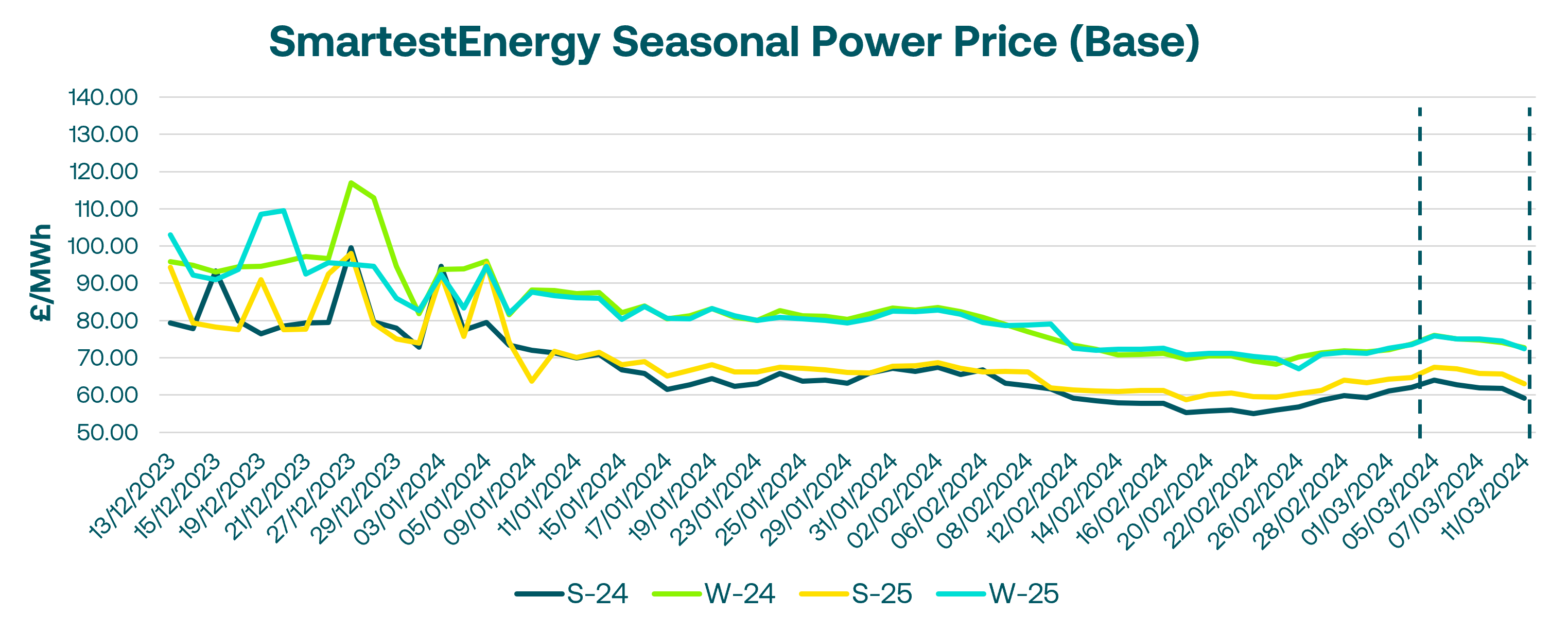

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 2nd April – 8th April 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £64.33/MWh for the Summer-24 seasonal power price on 5th April. In this blog, Fanos shares the market news and updates from the last week.

The week began with a shift in focus to May and June contracts as April and Summer 2024 contracts expired, boosting liquidity in those months. Milder temperatures and high winds reduced gas demand for power, leading to an oversupplied UK gas system. Norwegian gas flows also increased.

On Wednesday, prices dipped due to stable supply and weak demand. Strong LNG deliveries, including a first-time shipment from the Republic of Congo, continued. The UK power market followed the downward trend in gas and carbon prices. Despite a slight uptick in gas prices on Thursday, the overall outlook remained bearish due to high storage levels and strong renewables output. Weekend power prices remained flat, and trading activity focused on May and Q3 2024 contracts.

The prompt market opened significantly bearish on Friday due to abundant supplies. Despite a temporary rise in demand from colder temperatures, the UK gas system remained long. The UK power auction reflected weak demand with negative prices for some periods. Forward prices initially dipped but recovered later, supported by buying activity and rising gas prices for the near future.

Storm Kathleen kept gas demand for power generation low on Monday, but a shortage emerged due to colder weather forecasts and thin liquidity. This triggered a price increase, highlighting the potential for short-term volatility despite the underlying bearish trend.

United States

United States Australia

Australia