Posted on: 07/05/2024

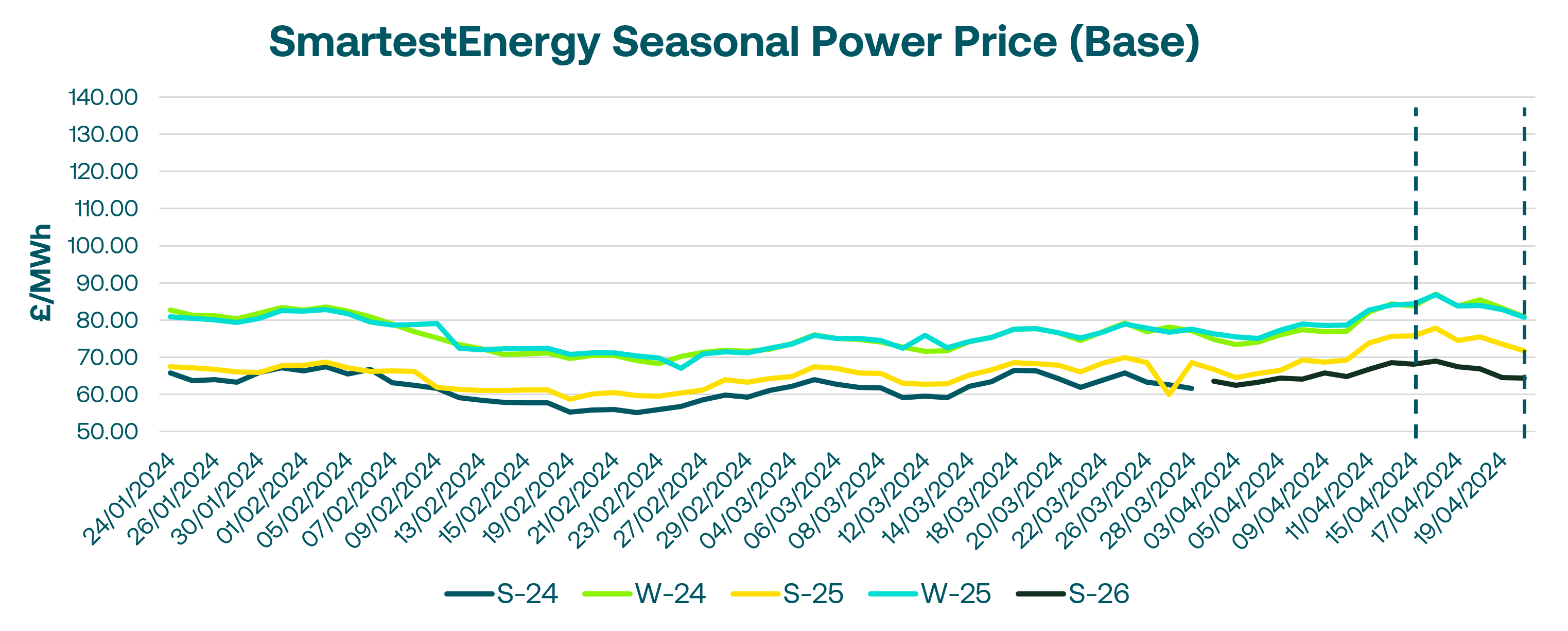

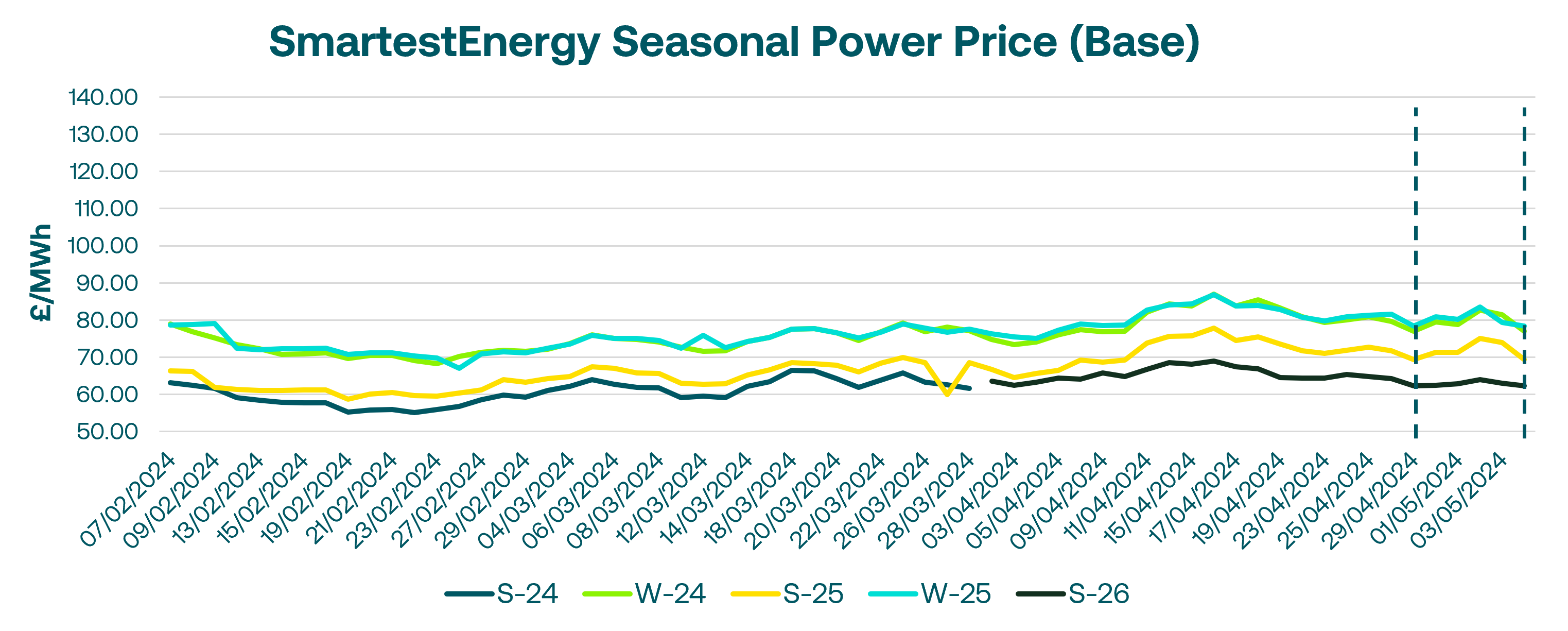

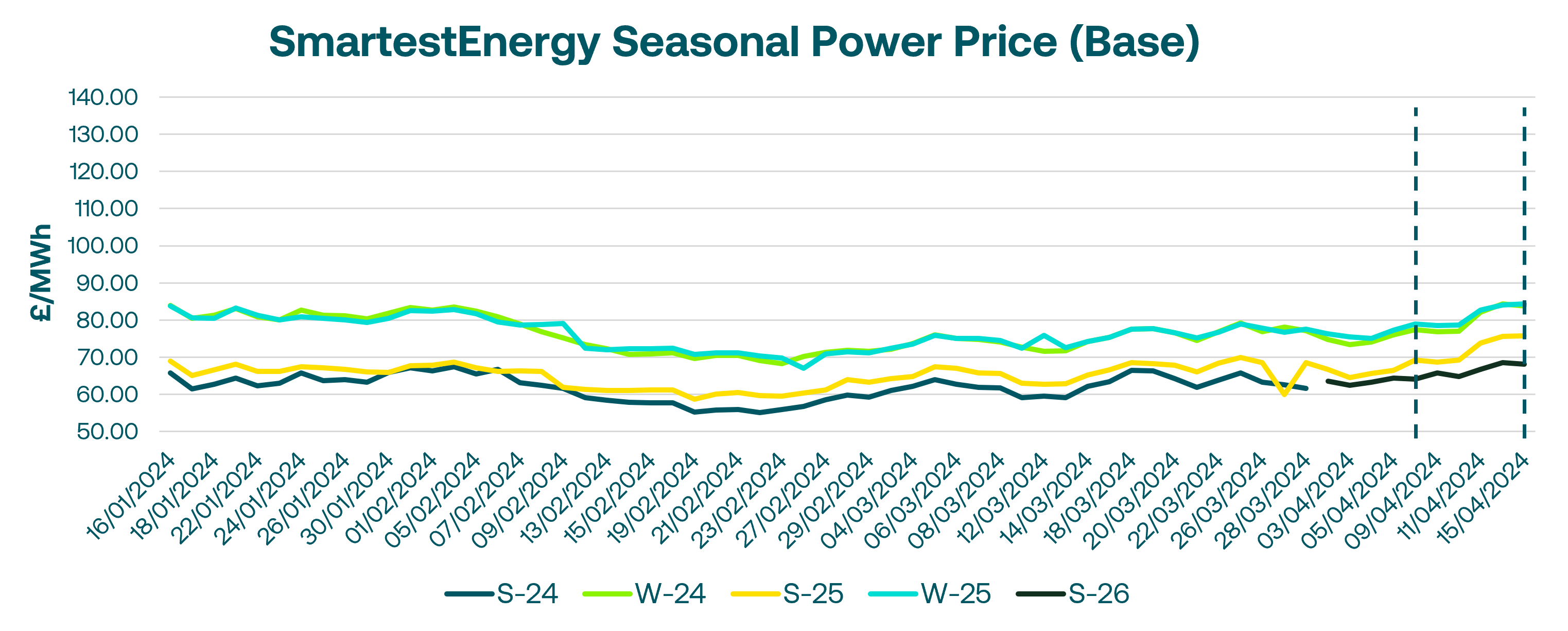

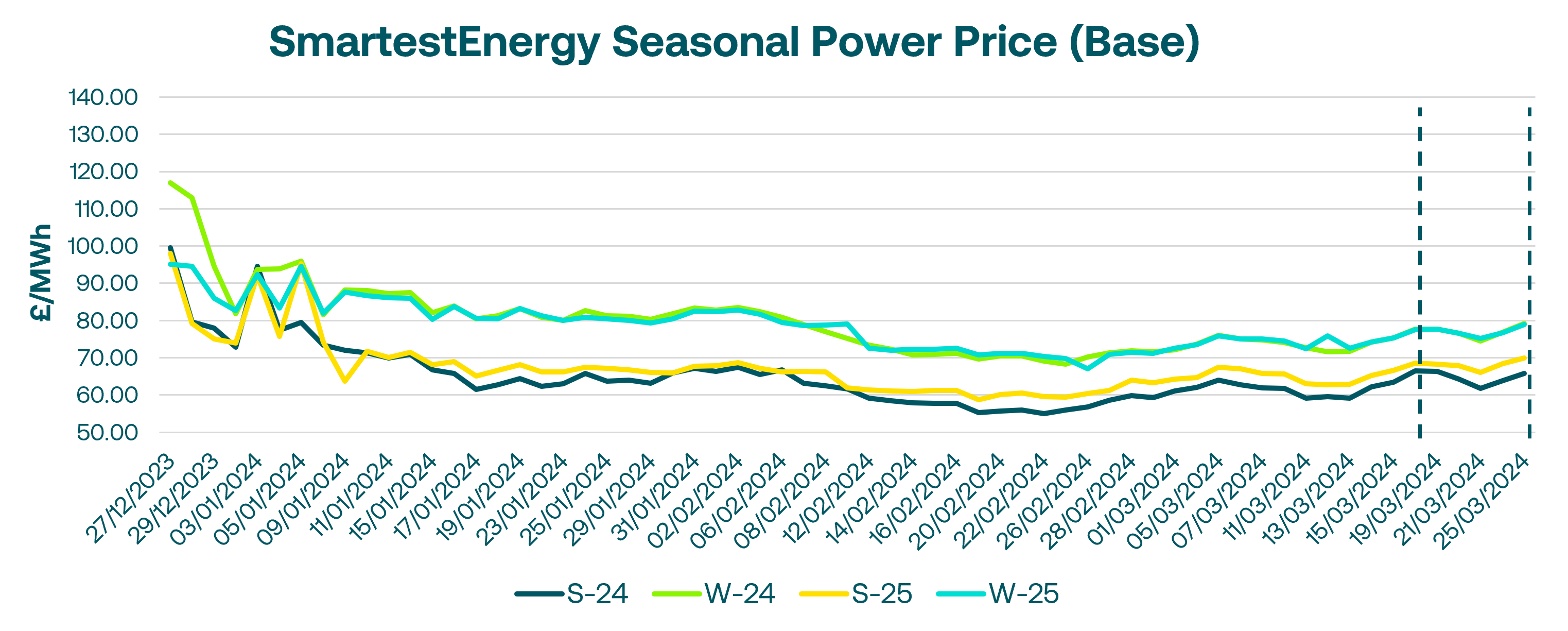

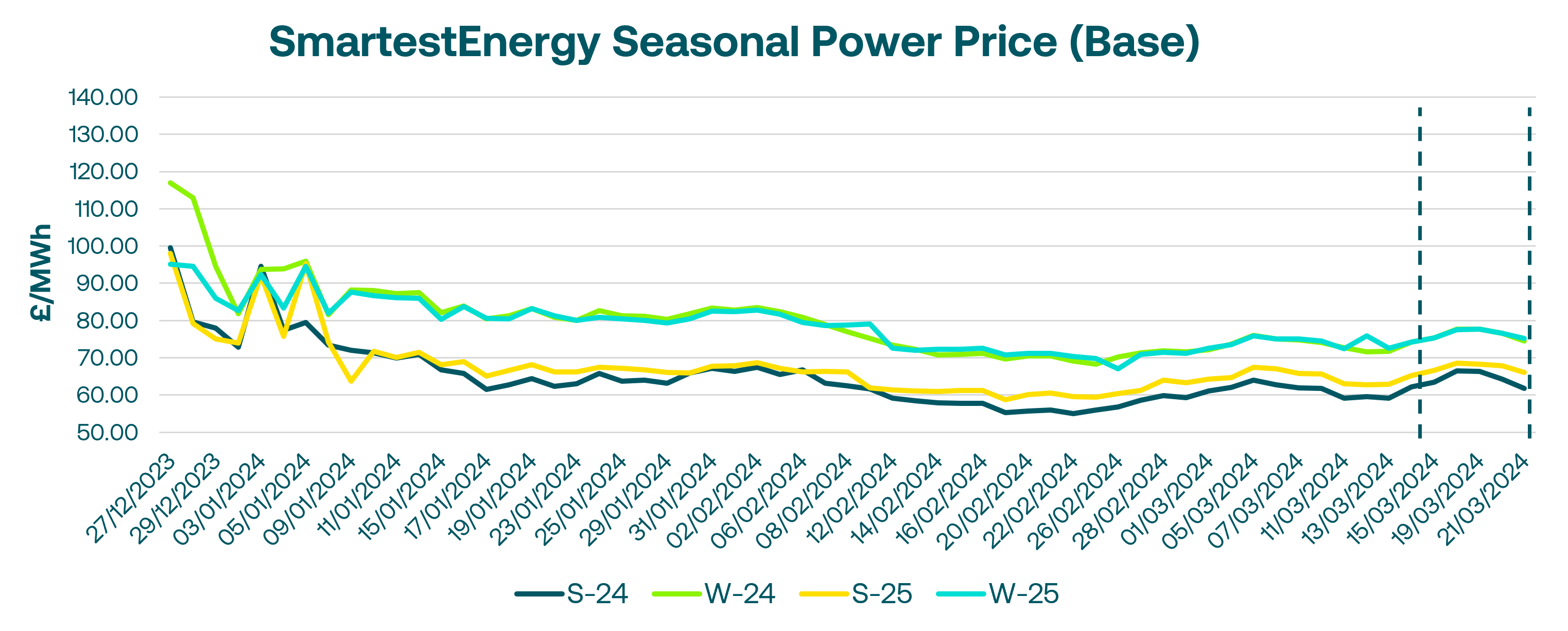

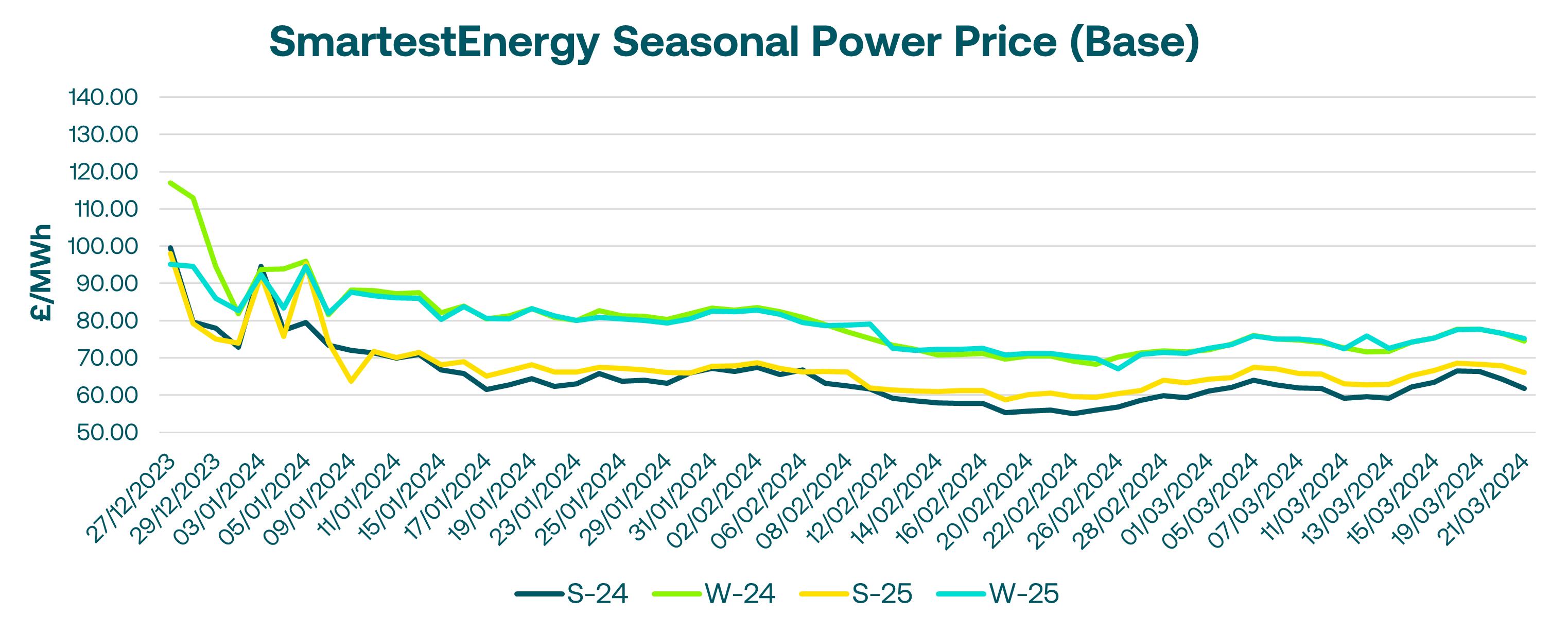

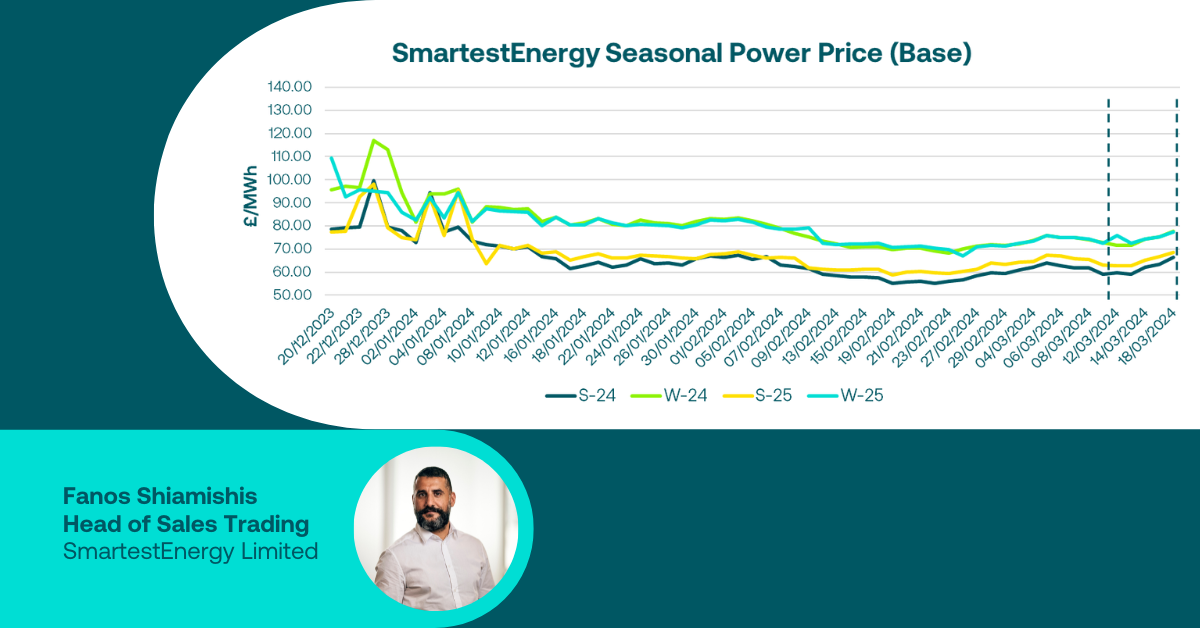

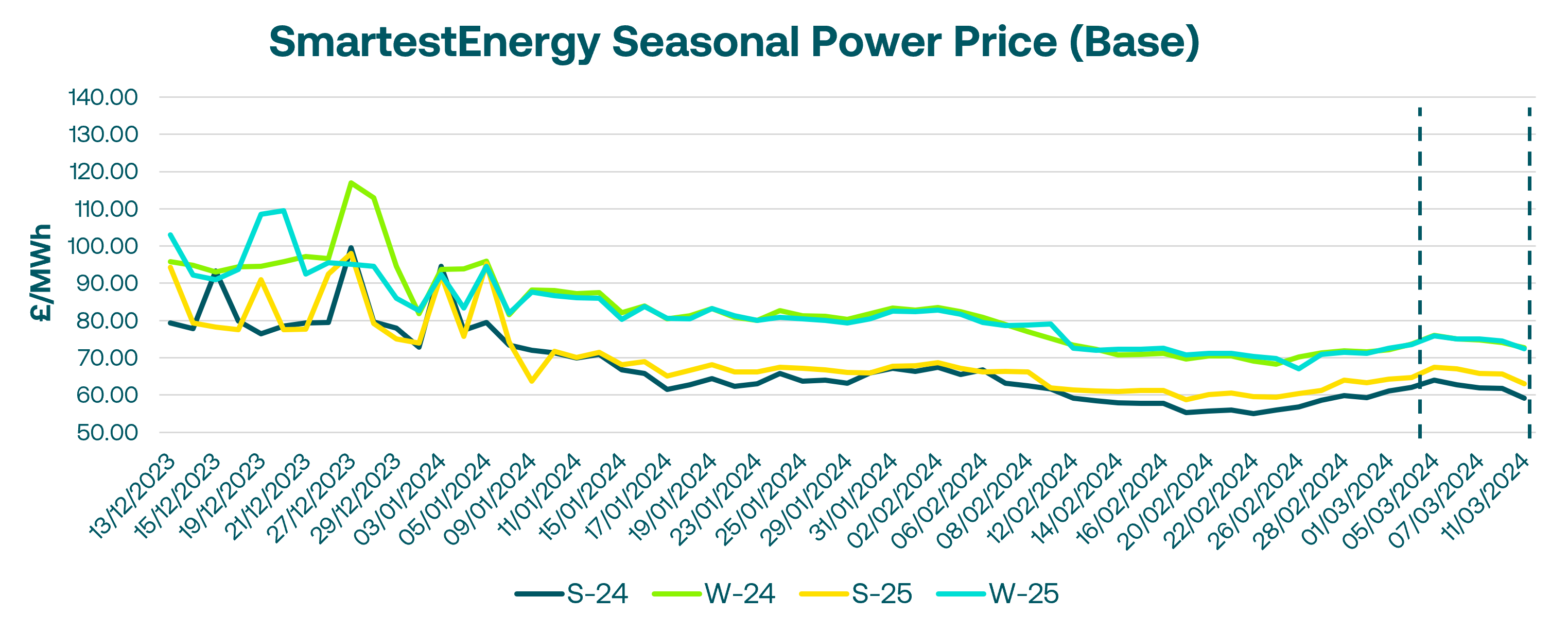

VP Trading, Fanos Shiamishis, reports on energy market activity, covering the period 30th April – 3rd May 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £64.03/MWh for the Summer-26 seasonal power price on 2nd May. In this blog, Fanos shares the market news and updates from the last week.

UK Gas & Power: Momentum Trading Trumps Fundamentals in Volatile Week for UK Markets

European gas prices recovered on Tuesday due to a slight drop in Norwegian supplies, though gains were limited as warmer weather above seasonal norms was expected for the week ahead and gas storage levels remained comfortable at 62% full. UK power followed the rally in gas, coal and carbon markets, with the May-24 baseload forward contract expiring at £62.50/MWh. The highest volume traded UK power contract was June-24 baseload with 360MW total volume, becoming the front-month product from Wednesday. Despite rising wind generation, day-ahead baseload closed around £5/MWh higher, supported by strength in the gas prompt.

On Wednesday, the weather outlook indicated a drier, sunnier forecast with above seasonal normal temperatures, supporting high solar output and reduced demand. The UK gas system opened 16mcm oversupplied with gas burn for power down 18mcm day-on-day amid increased wind output. While TTF saw gains on Tuesday from reduced Norwegian flows, these were reversed on Wednesday, feeding through to the new front-month June 24 contract.

Thursday saw the UK gas system revert to an undersupplied position with demand up 10mcm, including a 9mcm rise in gas burn for power generation. Despite a tighter supply outlook, there were no significant fundamental changes to justify the day's increase in forward prices. After a strong open, very thin trading led to small sporadic trades establishing benchmarks that gained enough momentum to close out substantially higher.

European gas edged down on Friday, erasing the previous day's gains amidst profit-taking as the latest Commitment of Traders report reflected more speculative players taking a bullish long-term price view. UK power followed the downturn in gas and carbon markets, with Q3-24 the most liquid contract trading 240MW total volume.

United States

United States Australia

Australia