Posted on: 30/04/2024

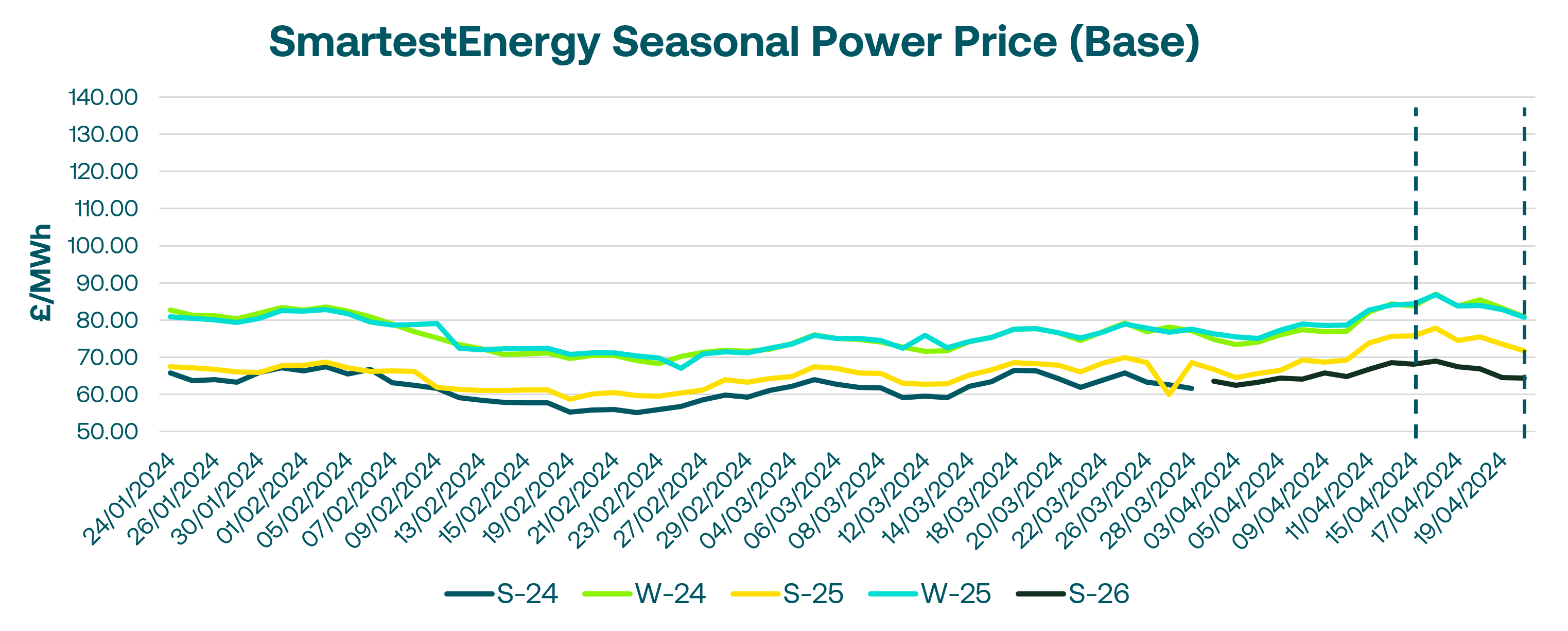

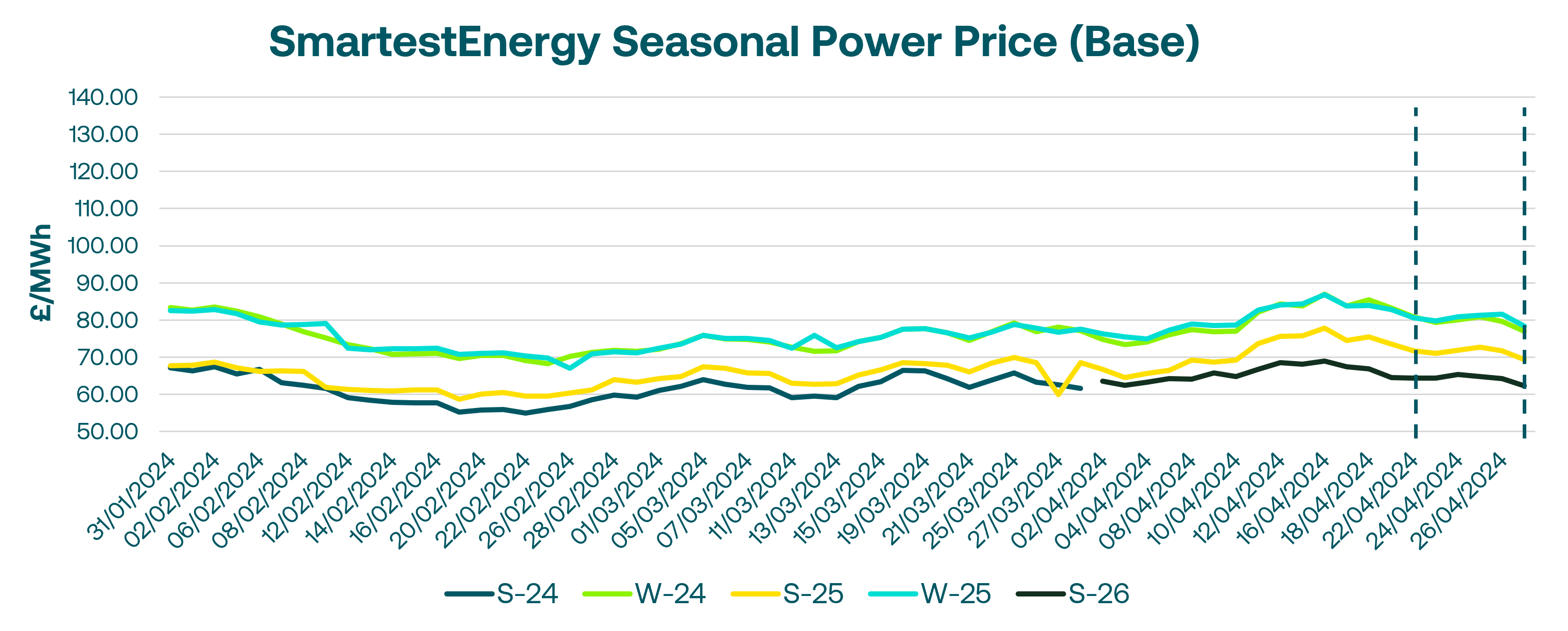

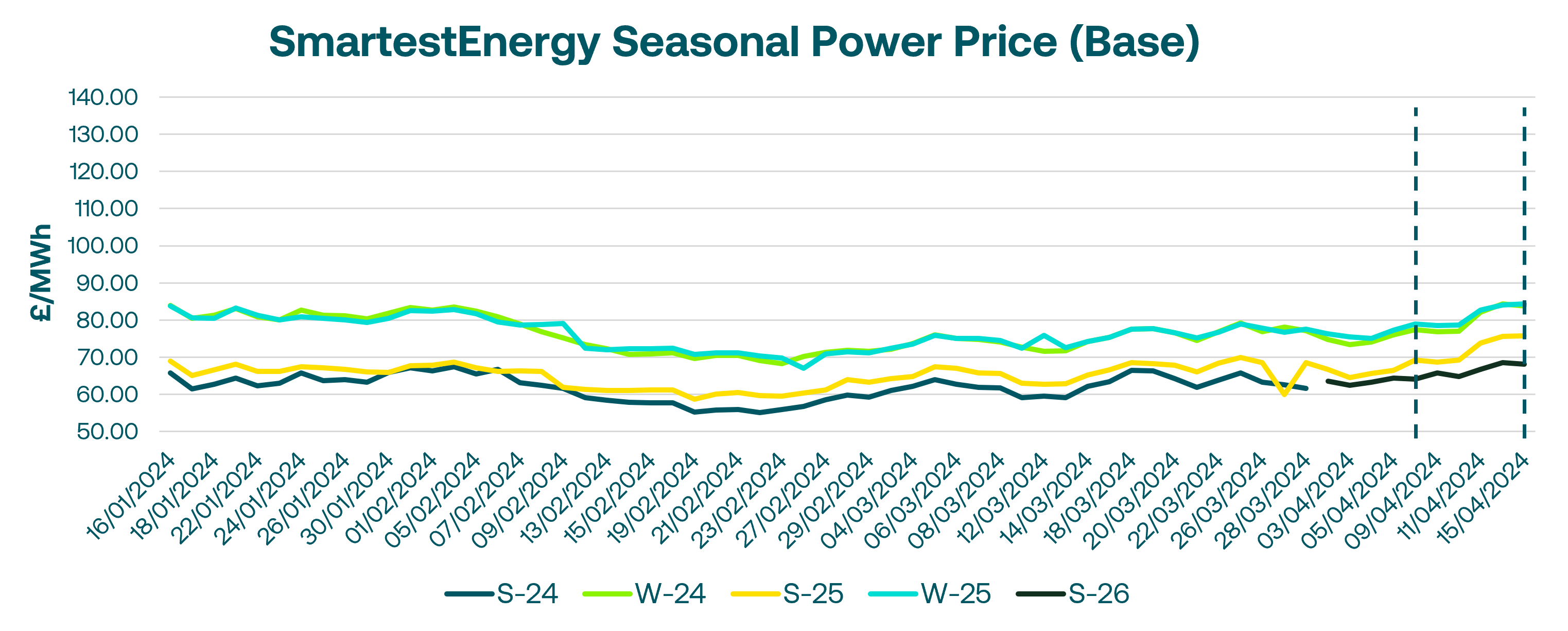

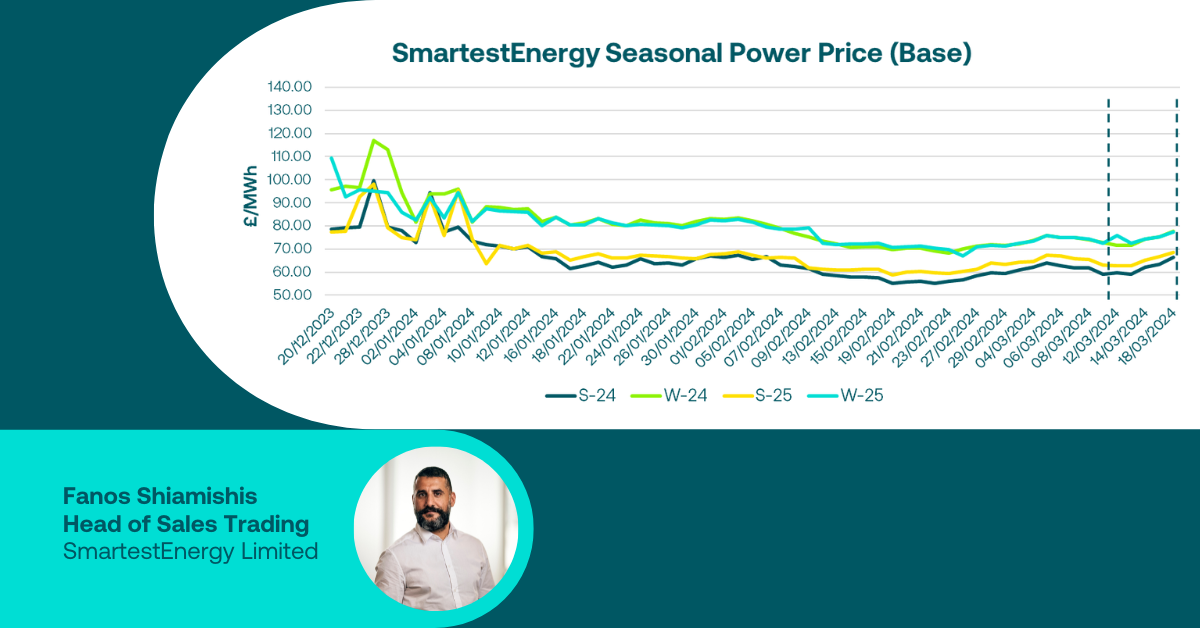

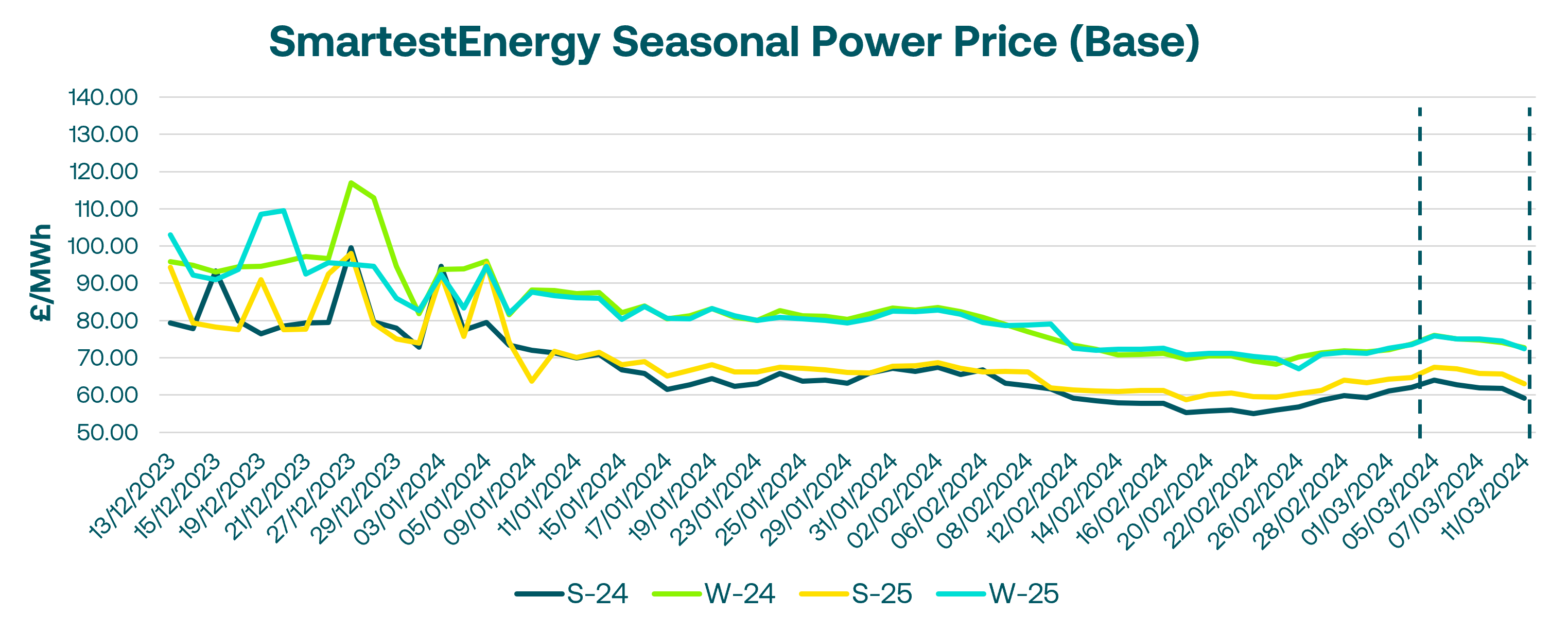

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 23rd April – 29th April 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £65.41/MWh for the Summer-26 seasonal power price on 24th April. In this blog, Fanos shares the market news and updates from the last week.

Tuesday saw bearish sentiment prevail despite an increase in day-ahead gas burn for power generation, as demand was expected to ease thereafter. Norwegian flows were marginally higher while other supply factors remained unchanged. UK power trading was sporadic but consistently trended lower from the open, with the front-month, quarter, and season contracts seeing over 300MW, 100MW traded respectively as they tracked the downturn in NBP and TTF prices.

On Wednesday, the UK gas system opened 6mcm oversupplied though supplies were reduced from Norway and the UKCS amid unplanned outages at Bacton. Demand was expected to pick up heading into next week while Norwegian flows to Europe were forecast to decline during the maintenance period. Despite largely unchanged fundamentals across Europe, TTF opened strongly before paring gains by the close. Both UK and European power and gas markets managed to retain enough value to register modest day-on-day gains before the late sell-off.

European gas traded higher on Thursday as colder weather across the continent halted storage injections, compounded by Norwegian flows at their lowest since early February due to planned outages. UK power prices firmed tracking the gas and carbon gains, with nearly 900MW of May 2024 baseload trading as the contract neared expiry.

However, the bullish momentum faded on Friday as Norwegian maintenance eased and supply prospects improved heading into next week. Thursday's gains across European and UK power and gas markets were reversed.

The week began with the UK gas system opening 8mcm undersupplied on Monday amid higher gas burn for power generation and reduced Norwegian exports. Despite the supply tightness, overall expectations remained bearish with total demand forecast to drop 29mcm/d on rising temperatures. Forward prices sold off with TTF also lower on bearish European demand projections.

United States

United States Australia

Australia