Posted on: 26/03/2024

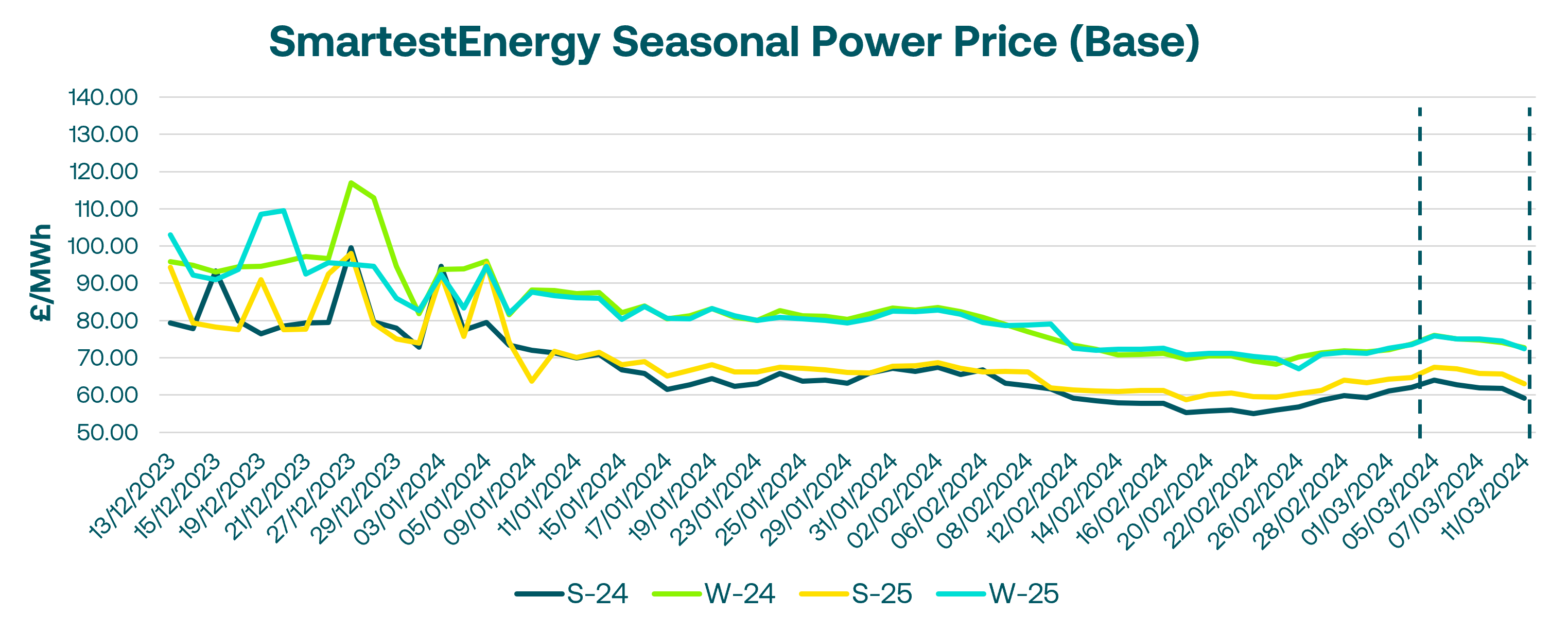

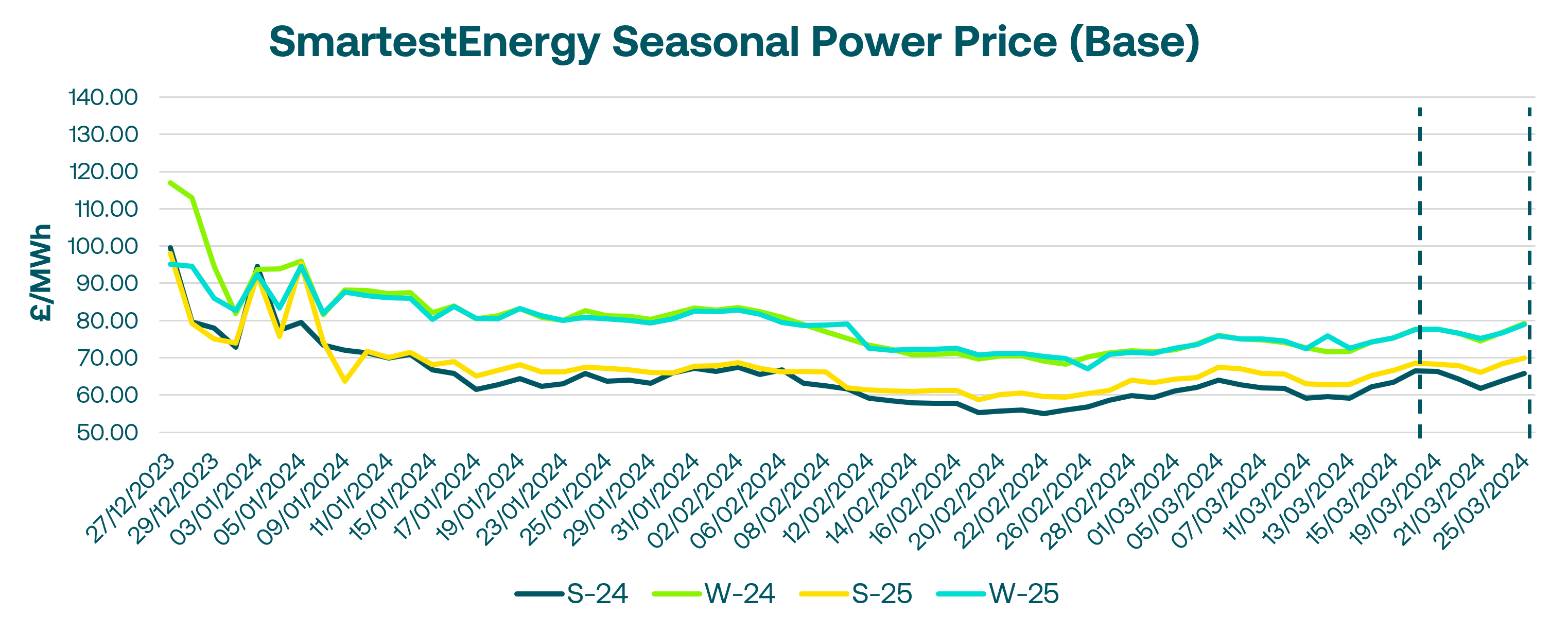

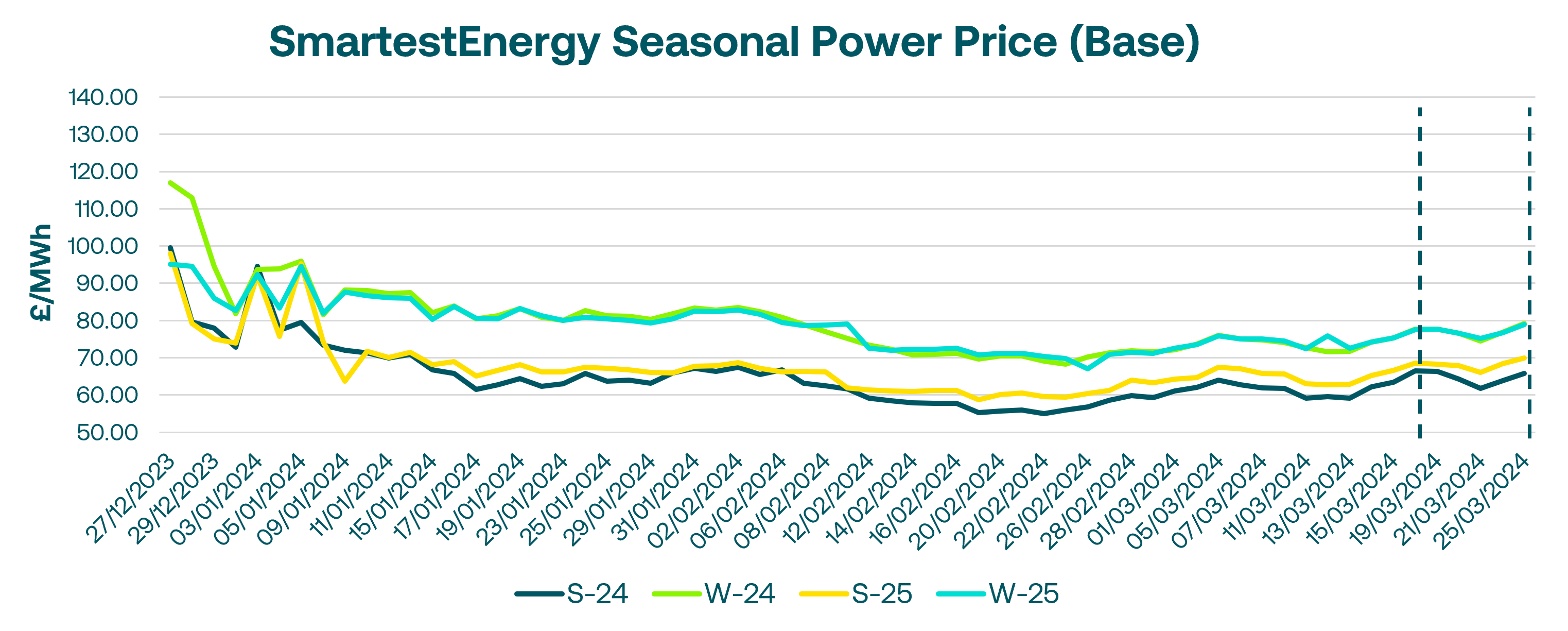

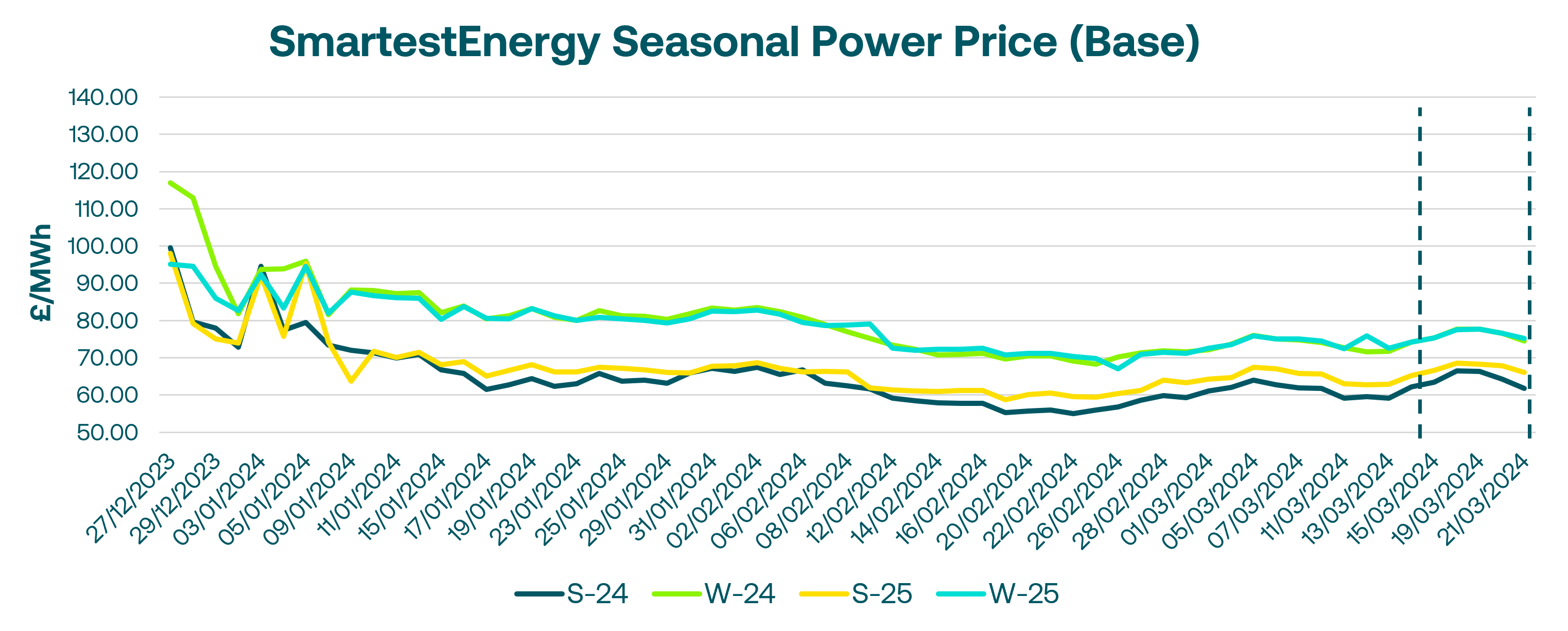

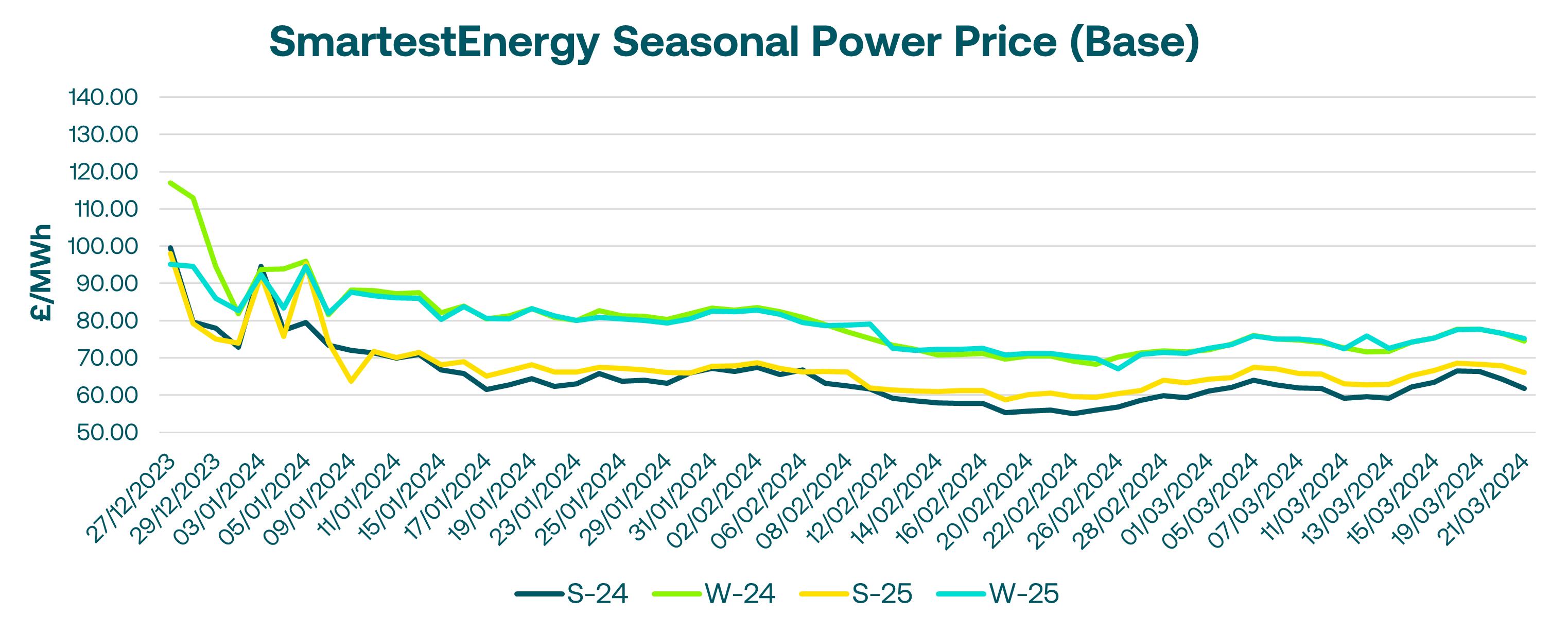

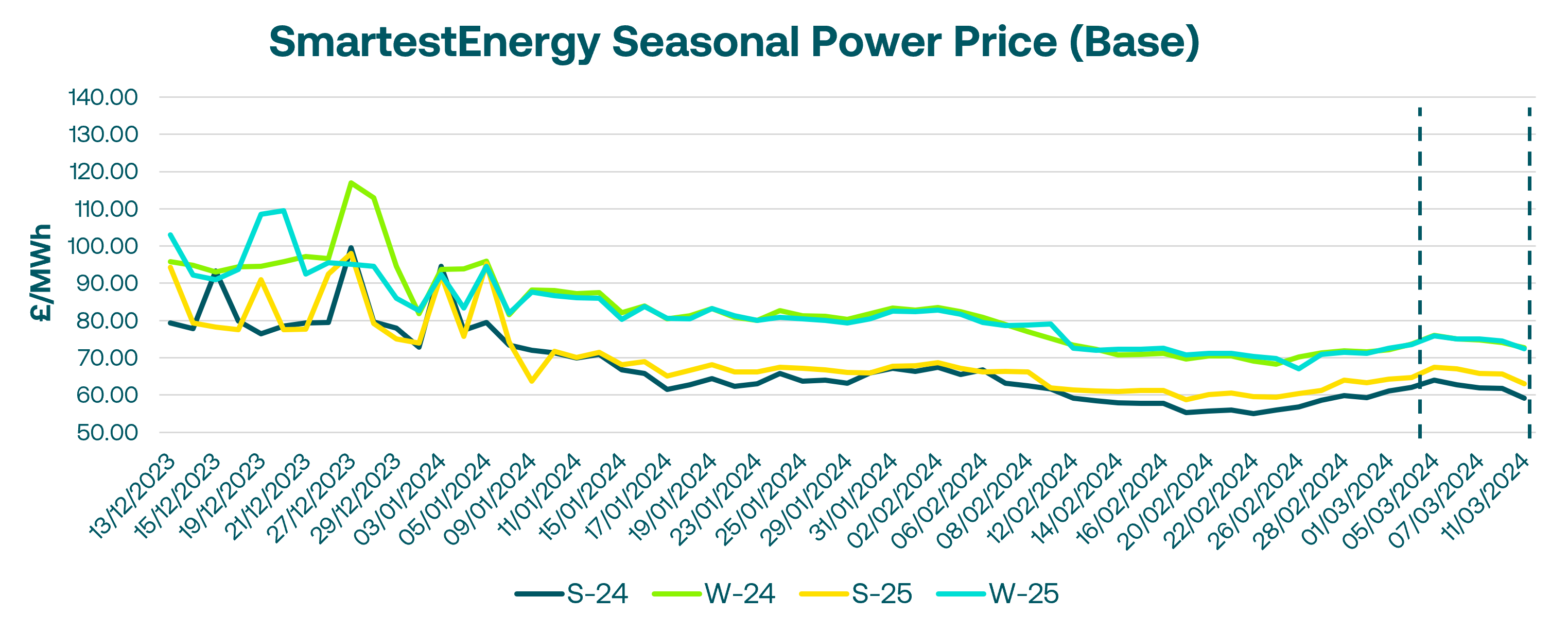

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 19th March – 25th March 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £66.40/MWh for the Summer-24 seasonal power price on 19th March. In this blog, Fanos shares the market news and updates from the last week.

The UK gas system opened 3mcm undersupplied Tuesday morning as temperatures held steady day-on-day but gas burn for power generation increased amid low wind output and higher thermal generation requirements. This drove an upturn in very near-term prompt prices. Front-month gas and power contracts saw real intraday volatility - initially retracting following Monday's rally before reversing to net daily gains, only to sell off again late in the session. Gas followed a similar pattern but closed out roughly flat to slightly higher on the day.

European gas prices dropped further on Wednesday as milder weather and comfortable supply offset the impact of growing Asian LNG demand. UK power was also weaker, though losses were limited by strength in the carbon market.

Strong supply across prompt and forward power and gas periods triggered an overall selloff Thursday. High UK wind output and reduced gas demand left the system opening 39mcm oversupplied.

NBP gas closed out the week with small gains on Friday. Prices rose amid forecasts for colder weather, though April is expected to trend at seasonal norms. The UK system was oversupplied in the morning as renewable output increased. Wind peaks of 14GW were expected Saturday before dipping to 2GW late Sunday. UK power tracked higher gas and carbon markets, trading up £1-2/MWh.

European gas started the new week higher Monday on concerns over maintenance at Freeport LNG, though the rally should be temporary with bearish fundamentals persisting. UK power also traded up, supported by strong emissions markets. With the April 2024 and Q2 2024 contracts nearing expiry, liquidity was high in those two products.

United States

United States Australia

Australia